ITR 3 Filing Consultant

Looking for an expert ITR-3 Filing Consultant? Legal Adda offers professional assistance for individuals and HUFs having income from business, profession, or partnership firms. Our experienced team ensures accurate preparation and filing of your ITR-3, including profit & loss statements, balance sheets, depreciation schedules, and deductions as per the latest Income Tax rules. Whether you are a freelancer, consultant, trader, or business owner, we help you maximize tax benefits, stay compliant, and avoid notices. With CA-certified accuracy and hassle-free online filing, Legal Adda ensures your return is filed on time and error-free. Choose Legal Adda for fast, reliable, and expert ITR-3 filing services trusted by professionals across India.

Looking for Expert Help in ITR-3 Filing? Get in Touch!

What is ITR-3 Filing?

ITR-3: Business Return – Comprehensive Individual Taxpayer Return with Business Activities refers to an income tax return form designed for individuals and Hindu Undivided Families (HUFs) who are engaged in business or professional activities and need to report their total income comprehensively. It is a detailed return that covers all sources of income, including profits from business or profession, salary or pension, house property income, capital gains, and other sources like interest or dividends.

This form is meant for taxpayers who maintain regular books of accounts and may require an audit under the Income Tax Act, 1961. The ITR-3 form provides a complete picture of a taxpayer’s financial position, including assets, liabilities, and tax computations. It allows taxpayers to disclose their business turnover, profit and loss account, and balance sheet details, ensuring accurate tax reporting and compliance. Filing ITR-3 is mandatory for individuals whose income is derived from proprietary businesses or professional practices such as doctors, consultants, lawyers, or freelancers with substantial business income.

In essence, ITR-3 serves as a comprehensive return for individual taxpayers with business or professional income, ensuring proper declaration of earnings, claiming of deductions, and calculation of tax liabilities in accordance with Indian tax laws.

Who Should File It?

ITR 3 should be filed by individuals and Hindu Undivided Families (HUFs) who have income from a business or profession carried on under their own name or through a proprietorship. It is specifically meant for taxpayers whose income cannot be reported under ITR 1, ITR 2, or ITR 4 because they are engaged in regular business or professional activities.

You should file ITR 3 if you fall under any of the following categories:

You are a self-employed professional such as a doctor, chartered accountant, lawyer, architect, consultant, or designer.

You are a proprietor of a business or own a small or medium enterprise registered in your name.

You are a partner in a partnership firm (but not the firm itself) and earn income as profit, interest, or commission from the firm.

You earn income from house property, capital gains, or other sources such as interest, dividends, or foreign income, in addition to your business income.

You maintain books of accounts and want to claim business expenses or depreciation on your assets.

In short, ITR 3 is meant for those who are actively running a business or practicing a profession and need to report detailed financial statements to the Income Tax Department.

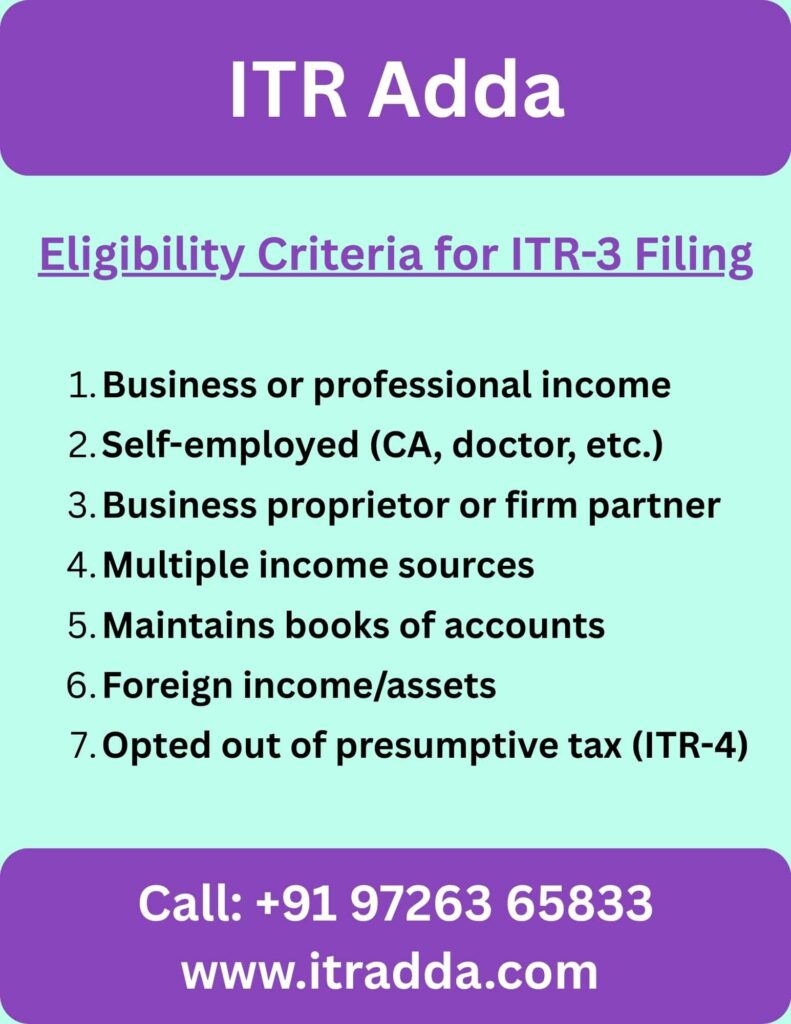

Eligibility Criteria for ITR 3 Filing

You should file ITR 3 if you are:

Types of Income Covered Under ITR 3

The ITR 3 form is meant for individuals and HUFs earning income from various sources, primarily business or professional activities. It allows detailed reporting of multiple income types under one return.

Here are the main types of income covered under ITR 3:

In summary, ITR 3 covers almost every income source of individuals or HUFs engaged in business or professional work, along with any additional income from investments or properties.

Documents Required for ITR 3 Filing

PAN Card & Aadhaar Card

Form 16 / 16A (TDS certificates)

Bank statements

Books of accounts (Balance Sheet & P&L Account)

Details of business or professional income

GST details (if applicable)

Income from house property (rent, loan interest, etc.)

Capital gains statements (shares, property, mutual funds)

Investment proofs for tax deductions (80C, 80D, etc.)

Form 26AS / AIS / TIS

Foreign income or asset details (if any)

Audit report (if applicable)

Why Hire a Professional ITR 3 Filing Consultant?

Filing ITR 3 can be complex because it involves detailed financial reporting, balance sheets, and profit & loss statements. A professional consultant ensures your return is accurate, compliant, and filed on time.

Here’s why hiring an ITR 3 filing expert is beneficial:

Error-Free Filing – Avoid mistakes that could lead to notices or penalties.

Maximize Tax Savings – Professionals identify all eligible deductions and exemptions.

Stay Compliant – Consultants stay updated with the latest tax rules and deadlines.

Save Time & Effort – Let experts handle calculations, forms, and documentation.

Accurate Financial Reporting – Properly prepare and verify your business financials.

Peace of Mind – Get end-to-end support from data collection to acknowledgment.

Required Financial Statements for ITR 3

For ITR 3 filing, the following financial statements are needed:

Balance Sheet – Details of assets, liabilities, and capital.

Profit & Loss Account – Summary of income, expenses, and net profit or loss.

Ledger & Journal Entries – Record of all business transactions.

Cash Flow Statement (optional) – Shows cash inflows and outflows.

These documents ensure accurate reporting and compliance during ITR 3 filing.

How to File ITR 3 – Complete Process

Step 1: Collect Documents

Gather PAN, Aadhaar, bank statements, Form 16/16A, and business financial records.

Step 2: Prepare Financial Details

Create your Balance Sheet, Profit & Loss Account, and calculate total income from all sources.

Step 3: Compute & File ITR 3

Claim deductions, calculate tax payable, and file the ITR 3 form on the Income Tax e-filing portal.

Step 4: Verify & Get Acknowledgment

E-verify your return using Aadhaar OTP or net banking, and download the ITR-V acknowledgment.

Contact Our ITR 3 Filing Experts Today

Filing ITR 3 can be complex, especially for professionals and business owners dealing with multiple income sources, business expenses, and financial statements. Our team of expert Chartered Accountants (CAs) specializes in ITR 3 filing, ensuring your return is accurate, compliant, and optimized for maximum tax savings.

Whether you’re a self-employed professional, a proprietor, or a partner in a firm, our experts will handle your filing from start to finish — from preparing financial statements to e-verifying your return — with complete accuracy and confidentiality.