ITR 4 Filing Consultant

ITR 4 Filing is meant for small business owners and professionals who opt for the presumptive taxation scheme to simplify their income tax filing. It allows taxpayers to declare income on a lumpsum basis without maintaining detailed books of accounts. With the help of an expert ITR 4 filing consultant, you can ensure accurate, timely, and compliant filing while minimizing tax liabilities and avoiding penalties.

Get Professional Support for ITR 4 Filing

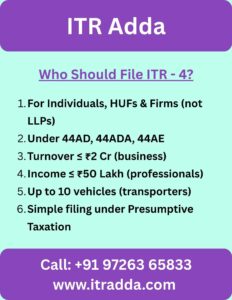

What is ITR 4 and Who Should File It?

ITR 4, also known as the Sugam Form, is designed for individuals, Hindu Undivided Families (HUFs), and partnership firms (excluding LLPs) who opt for the presumptive taxation scheme under Sections 44AD, 44ADA, or 44AE of the Income Tax Act.

This form is ideal for small business owners, professionals, and transporters who prefer to declare income on a lumpsum basis instead of maintaining detailed books of accounts. Under this scheme, a fixed percentage of turnover or gross receipts is treated as taxable income.

You should file ITR 4 if:

Your total business turnover does not exceed ₹2 crore (under Section 44AD).

You are a professional (like a doctor, CA, architect, or consultant) with income up to ₹50 lakh (under Section 44ADA).

You are engaged in the transport business with up to 10 goods vehicles (under Section 44AE).

Filing ITR 4 simplifies tax compliance, reduces paperwork, and helps small taxpayers save time while staying compliant with income tax regulations.

Eligibility Criteria for ITR 4 Filing

The ITR 4 form is meant for individuals, Hindu Undivided Families (HUFs), and partnership firms (other than LLPs) who opt for the presumptive taxation scheme under Sections 44AD, 44ADA, or 44AE of the Income Tax Act. This scheme allows small taxpayers to declare income at a fixed percentage of turnover, making tax filing simpler.

You are eligible to file ITR 4 if:

You are an individual, HUF, or partnership firm (not an LLP).

Your business turnover is up to ₹2 crore (under Section 44AD).

You are a professional (doctor, CA, consultant, architect, etc.) with gross receipts up to ₹50 lakh (under Section 44ADA).

You are engaged in the transport business with up to 10 goods vehicles (under Section 44AE).

You have income from salary, one house property, or other sources (like interest or dividends) in addition to presumptive income.

You are an Indian resident and not earning foreign income or owning foreign assets.

In short, ITR 4 is ideal for small businesses and self-employed professionals who want to save time and reduce compliance through simplified tax filing.

Who Can Opt for Presumptive Taxation?

The Presumptive Taxation Scheme is designed to simplify income tax filing for small businesses and professionals by allowing them to declare income at a fixed percentage of their turnover or receipts, instead of maintaining detailed books of accounts.

You can opt for presumptive taxation if you fall under any of the following categories:

Small Business Owners under Section 44AD with annual turnover up to ₹2 crore. (Example: shopkeepers, traders, service providers, small manufacturers, etc.)

Professionals under Section 44ADA with gross receipts up to ₹50 lakh. (Example: doctors, architects, consultants, lawyers, CAs, etc.)

Transporters under Section 44AE owning up to 10 goods vehicles during the financial year.

This scheme helps reduce compliance, save time, and avoid the need for audits or maintaining detailed financial records. It’s ideal for self-employed individuals and small businesses who want easy and hassle-free tax filing.

Key Benefits of Presumptive Taxation

The Presumptive Taxation Scheme offers a simple and convenient way for small businesses and professionals to file their income tax returns without maintaining detailed books of accounts. It helps reduce compliance, save time, and make tax filing effortless.

Here are the main benefits of opting for presumptive taxation:

Simplified Tax Filing – No need to maintain complex financial statements or records.

No Audit Requirement – Businesses under the presumptive scheme are exempt from tax audits (subject to conditions).

Time and Cost Saving – Less paperwork and lower compliance costs for small taxpayers.

Fixed Income Percentage – Income is declared as a fixed percentage of turnover or receipts, making calculations easy.

Reduced Compliance Burden – Ideal for small traders, professionals, and transporters with limited resources.

Encourages Voluntary Compliance – Simplifies tax payment and encourages more small businesses to file returns on time.

Businesses with Turnover Above the Limit

Businesses whose annual turnover exceeds ₹2 crore (for Section 44AD) or ₹50 lakh (for Section 44ADA – professionals) cannot opt for the presumptive taxation scheme. Such taxpayers must maintain regular books of accounts and file their return using ITR 3 instead of ITR 4.

They are also required to get their accounts audited under Section 44AB of the Income Tax Act. This ensures proper reporting of income, expenses, and tax liability.

In short, if your business turnover crosses the prescribed limit, you must shift from presumptive taxation to regular taxation, maintaining full financial records and complying with audit requirements.

Easy 4-Step Process to File Your ITR 4

Gather PAN, Aadhaar, bank statements, and income details.

Calculate turnover and presumptive income under 44AD, 44ADA, or 44AE.

Enter details and submit on the Income Tax e-Filing portal.

Verify your return and save the ITR-V acknowledgment.

Common Mistakes to Avoid in ITR 4 Filing

Using the wrong ITR form (not selecting ITR 4).

Exceeding turnover limits (₹2 crore / ₹50 lakh).

Selecting the wrong section (44AD, 44ADA, 44AE).

Missing other income sources like rent or interest.

Failing to e-verify after submission.

Entering incorrect bank details.

Inconsistent filing under presumptive taxation.

Reach Out to Our Expert CAs for ITR 4 Filing

Filing ITR 4 under the Presumptive Taxation Scheme can be simple when handled by professionals. Our team of experienced Chartered Accountants (CAs) specializes in ITR 4 filing for small businesses, professionals, and transport operators under Sections 44AD, 44ADA, and 44AE.

We ensure accurate filing, maximum deductions, and complete compliance with income tax laws — helping you avoid penalties and save valuable time. Whether you are a freelancer, consultant, or small business owner, our experts manage everything from document preparation to e-verification.

📞 Call: 9726365833

📧 Email: office@itradda.com

🌐 Website: itradda.com