How to Check Income Tax Refund Status Online ?

Welcome to our blog on How to Check Income Tax Refund Status Online! Checking your income tax refund is easier than ever and can save you a lot of time. You can track your refund using the official Income Tax e-Filing portal, NSDL, or TRACES, and know exactly when the money will hit your account. All you need is your PAN number and a few details from your filed ITR. This guide will also explain how to check refunds for different financial years, understand the refund processing stages, and troubleshoot common delays. By following these simple steps, you can stay informed and avoid unnecessary stress while waiting for your refund.

What is an Income Tax Refund?

An income tax refund is the money the government returns to you when you’ve paid more tax than you actually owe. This can happen if your TDS (Tax Deducted at Source), advance tax, or self-assessment tax payments exceed your total tax liability for the financial year. Think of it as getting a little bonus back for paying extra! Receiving a refund means the government recognizes that you’ve paid more than required and wants to give it back to you.

Refunds can arise for different reasons, such as excess TDS deducted by your employer, errors in tax calculations, or advance tax paid in higher amounts. Thankfully, you don’t have to wait blindly—the government allows you to check your refund status online anytime. By tracking your refund, you can see the processing stages, know if there are any delays, and plan your finances better. Plus, it gives you peace of mind knowing exactly when the money will reach your bank account.

Who is Eligible for an Income Tax Refund?

Anyone who has paid more tax than they actually owe is eligible for an income tax refund. This includes salaried employees whose TDS (Tax Deducted at Source) is higher than their total tax liability, business owners who may have paid extra advance tax, and professionals who have filed their ITR correctly and declared all sources of income. The key is to file your Income Tax Return accurately—if you miss any income or make calculation errors, it can delay your refund or reduce the eligible amount.

Even if you are self-employed, have multiple sources of income, or have invested in tax-saving instruments, you may still be eligible for a refund if your total tax paid exceeds your actual liability. Keeping your tax documents like Form 16, Form 26AS, bank statements, and investment proofs organized can make the process smoother. Additionally, by checking your refund status online, you can track the progress of your refund, understand the processing stages, and plan your finances better. Filing your ITR correctly and on time ensures you get your refund without unnecessary delays, giving you peace of mind.

Common Reasons Why You Receive an Income Tax Refund

Income tax refunds are issued when you’ve paid more tax than necessary. The most common reasons include:

Excess TDS Deducted by Employers or Banks – Sometimes your employer or bank may deduct more tax than required based on your income, exemptions, or deductions.

Overpayment of Advance Tax or Self-Assessment Tax – If you pay more advance tax or self-assessment tax than your actual liability, the excess amount is refunded.

Errors in Tax Calculation or Deductions Claimed in ITR – Mistakes while calculating taxable income or claiming deductions can lead to higher tax payments, which are later refunded.

Tax Benefits Not Adjusted Earlier – Certain deductions or exemptions might not have been considered during TDS calculation but are claimed while filing ITR, resulting in a refund.

Refunds for Previous Year Adjustments – Sometimes, discrepancies from previous financial years or corrections requested by the taxpayer can lead to refunds.

Options of ITRs for Tax Filing in Agra: Individuals, Businesses, Entities

Let’s Explore ITR Forms for Agra Residents, Companies, and Firms Registered at Agra Address.

ITR-1: Suitable for Individuals in Agra with Salary and Interest Income (Up to 50 lakhs).

ITR-2: Designed for Agra Residents with Income from Capital Gain/Loss on Agra Property, Investments in Shares and Mutual Funds, Agriculture Income, etc. Individuals or HUFs can use this form. Persons with Business and Professional Income cannot file ITR 2.

ITR-3: Ideal for Agra Business Owners with Business and Professional Income.

ITR-4: Intended for Agra-Based Businesses Opting for Presumptive Taxation (Lumpsum).

ITR-5: Applicable for Partnership Firms and LLPs in Agra.

ITR-6: Designed for Companies in Agra (Private Limited, Limited, Section 8, etc.).

Documents Required to Check Refund Status

Before checking your income tax refund online, make sure you have a few important documents handy. Having these ready will make the process faster and hassle-free.

Documents Needed:

PAN (Permanent Account Number) – Your unique identification for all tax-related activities.

ITR Acknowledgment Number – Received after filing your Income Tax Return, used to track your refund.

Bank Account Linked to PAN – The refund will be credited to this account, so ensure the details are correct.

Form 26AS (Tax Credit Statement) – Optional but helpful to verify TDS and other tax payments.

Registered Mobile Number or Email – To receive OTPs or updates while checking your refund status online.

Different Ways to Check Refund Status Online

There are multiple ways to check your income tax refund online, making it convenient for taxpayers to stay updated. Here are the main methods:

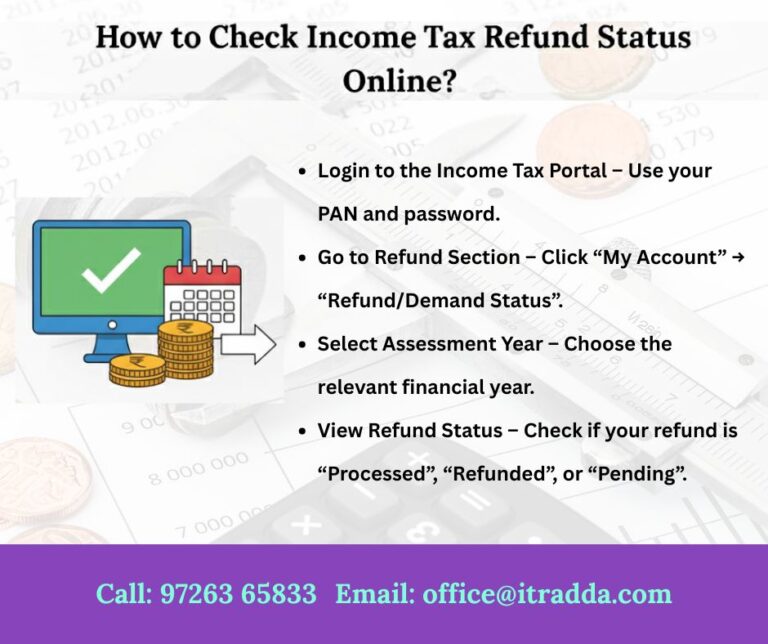

Income Tax e-Filing Portal – The official e-Filing website allows you to track your refund quickly. Simply log in with your PAN and password, go to the “My Account” section, and click on “Refund/Demand Status” to view details. This method is ideal for most taxpayers.

TIN-NSDL Website – The Tax Information Network (TIN) portal is another option. You only need your PAN and the Assessment Year for which the refund is being claimed. It shows the refund status along with the date of credit.

TRACES Website – Mainly used by taxpayers who are claiming TDS refunds. TRACES provides detailed information about TDS-related refunds and is helpful if your refund is due from TDS adjustments.

Step-by-Step Guide to Checking Refund Status via Income Tax e-Filing

We make checking your income tax refund completely stress-free. Instead of spending hours figuring out the portal, our experts handle the entire process for you, ensuring accuracy and privacy.

Share Your Details – Simply provide your PAN, ITR acknowledgment number, and the bank account linked to PAN. All your information is kept fully secure and confidential.

Secure Login by Experts – Our trained team logs into the Income Tax e-Filing Portal on your behalf, so you don’t have to worry about technical issues or errors.

Track Refund Status – We check your refund amount, current processing stage, and the estimated date of credit. We also verify if any additional action is needed to avoid delays.

Get Clear Updates – You receive a detailed update on your refund status, along with guidance if any follow-up is required.

You save time, avoid confusion, and get professional support to ensure your refund is tracked accurately. Whether it’s a TDS refund, advance tax adjustment, or excess tax payment, we help you stay informed every step of the way.

How to Track Refund Status for FY 2024-25 vs Previous Years ?

Tracking your income tax refund may differ depending on the financial year. Here’s how to do it accurately:

Select the Correct Assessment Year – Always choose the Assessment Year (AY) that corresponds to the financial year of your ITR. For example, FY 2024-25 corresponds to AY 2025-26. Previous years will have different assessment years, so ensure you select the correct one.

Use Year-Specific Details – For tracking refunds from earlier years, you may need the ITR acknowledgment number and login credentials specific to that year.

Check Refund Processing Stage – Each financial year’s refund is processed separately. Make sure you are checking the correct year to see accurate refund status.

Verify Bank Details – Ensure the bank account linked to your PAN for that particular year is correct, as refunds are credited to the same account.

Avoid Common Mistakes – Don’t confuse the current year’s refund with pending refunds from previous years. Always confirm the assessment year to avoid errors or delays.

Common Reasons Why Income Tax Refunds Get Delayed

Sometimes, income tax refunds take longer than expected. Understanding the common reasons can help you troubleshoot issues before seeking professional help:

Mismatched Bank Account Details – If the bank account linked to your PAN or ITR has incorrect details, the refund may be returned or delayed. Always double-check account numbers and IFSC codes.

Errors in Filed ITR – Mistakes in income details, deductions, or tax calculations can trigger delays, as the Income Tax Department may need to verify or correct them.

Manual Verification by the Tax Department – Certain cases require manual review, especially if your refund is large or involves multiple adjustments. This verification can take additional time.

Pending Adjustments from Previous Years – If there are discrepancies or pending refunds from earlier assessment years, they may affect the processing of your current refund.

Technical or System Delays – Occasionally, online processing delays or technical issues on the e-Filing portal can postpone refund updates.

Professional Help for Hassle-Free Refund Tracking

If you’re facing errors, delays, or confusion while checking your income tax refund, ITRAdda.com can make the process simple and stress-free. Our team of experts tracks your refund status on your behalf, identifies any issues, and guides you step by step until the refund is successfully credited to your account. This saves you time and ensures accuracy without the hassle of navigating complex portals.

With ITRAdda.com, you get personalized support for all types of refunds, whether it’s from TDS, advance tax, or excess tax payments. Our professionals also help troubleshoot common issues like mismatched bank details, ITR errors, or pending adjustments, so you don’t have to worry about delays. Get in touch with us today for expert assistance:

📞 Contact: +91 97263 65833

🌐 Website: itradda.com