ITR 1 Filing Consultant

Are you searching for an ITR-1 filing consultant? If so, you’ve come to the right place. We offer comprehensive Income Tax Return (ITR) filing services across India. If you earn income solely from salary and other sources, you can file the ITR-1 form. Therefore, if you’re a salaried individual with income from employment, interest, or other sources, you qualify for filing ITR-1. If you prefer filing ITR-1 with the assistance of a chartered accountant, ITR Adda is the ideal platform to connect with. File your ITR-1 salary return within one hour.

Looking for Salary (ITR-1) Filing Consultant?

ITR-1: Income Tax Return for Salaried Person

Income tax forms are documents through which taxpayers can provide information and submit it to the tax department. To make it easier for taxpayers, the Income Tax Department has categorized these forms based on usage and information requirements. Additionally, the department has introduced online filing methods for income tax returns. Through the online method, taxpayers can utilize forms ranging from ITR-1 to ITR-7 to file their returns.

ITR-1 is specifically designed for Resident salaried individuals who need to file their tax returns and make payments. Besides salary, individuals with additional income sources such as rent income on one property, interest, other earnings, and agriculture income (up to 5000) can also utilize ITR-1. However, it’s important to note that individuals earning over 50 Lakhs are required to use other applicable forms, as ITR-1 isn’t suitable for incomes exceeding this threshold. Therefore, employees working in various sectors including Central Government, State Government, pensioners, private employment, PSU’s, and other companies can use ITR-1.

If you’re interested in filing your salary income tax return (ITR-1), connect with our tax expert Chartered Accountant, who can provide you with assured and error-free return filing consultancy services.

Who Can File ITR-1?

Finding the suitability of an Income Tax Return Form can be complex, which is why we suggest filing your tax return through our ITR Specialist CA. Let’s analyze the eligibility criteria for ITR-1. ITR-1 can be filed by individuals who meet the following conditions:

- Only Indian resident individuals can file ITR-1.

- Total income must be less than 50 Lakhs.

- Income should only be derived from sources such as salary, rental income from one house, family pension income, agricultural income (maximum Rs. 5000), and other sources of interest income.

Who are not eligible for filing ITR-1?

In the following income and conditions, selecting ITR-1 for filing is not applicable for taxpayers:

- Individuals who are residents but not ordinary residents and NRIs.

- Total income exceeding 50 Lakhs.

- Higher agricultural income.

- Earning speculation income (from races, gambling, lottery).

- Generating income from capital gains.

- Earning income from business or profession.

- Holding the position of a director in a company.

- Receiving rent income from more than one property.

- Having income derived from ESOPs.

- When the conditions specified for ITR-1 are not fulfilled.

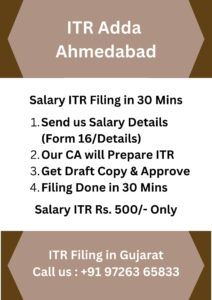

File Your Salary (ITR-1) Instantly

Require Salary Details required to send us via WhatsApp or Email.

We will check available online record of tax payer. That include 26AS, AIS, TIS of Taxpayer.

Our Expert Team of CA will prepare draft copy of ITR, We will confirm the tax amount or refund amount. Review and Approve ITR-1.

After Your Approval Our Chartered Accountant will file ITR-1 on your behalf.

Charges for ITR-1 (Salary Tax Return)

Charges for ITR-1 Filing With CA Consultation: Rs. 1000

Documents Required for ITR-1 Salary Return

Following Documents Required for ITR-1 Filing of Salaried Person.

- Bank Details

- Form 16/Salary Details/Salary Slips

- Deductions Details and Investment Details

- Other Income Details (if any)

Content and Details of Form ITR-1

Main Content and Details of ITR-1 are as

- Details of Tax Payer Name, Address and Contact Details.

- Employment type

- Salary Income Details with Incentives

- Details of Allowances like HRA, Leave in cash, etc

- TDS and Advance Tax

- Other Income Details

- Rent Income and Home Loan Details

- Tax Amount or Refund if any.

Advantages of ITR-1 Filing

Benefits of ITR-1 Filing

- Helps in Loan Application like Home Loan, Car Loan etc

- Income Proof

- Helps in filing of subsidies

- Helps in VISA Application

How to file ITR-1 With Two Form 16 of Multiple Salary Job?

If you have salary income from two jobs in a year, it’s necessary for the taxpayer to merge (combine) the salary income from both employers. This entails merging the information from two Form 16s as income. However, deductions can only be claimed within the allowable limits.

Chartered Accountant as ITR-1 Filing Consultant

Chartered Accountants (CAs) specialize in filing Income Tax Returns. CAs are experts in preparing ITR-1 with their in-depth knowledge of taxation, ensuring accurate and error-free filings. If you’re seeking a Chartered Accountant (CA) for filing your Salaried ITR-1, consult our team now for professional assistance.