ITR Filing Consultant in Amreli

Seeking an ITR filing consultant in Amreli? Look no further! Our team, based in Amreli, comprises experienced Chartered Accountants (CAs) and tax advisors offering professional income tax return filing services. Enjoy seamless ITR filing with us. Our expert Amreli consultancy team will analyze your documents, AIS, TIS, and 26AS to prepare a draft ITR and computation of income (COI). Upon your consent, we will proceed to file your online income tax return. Plus, we’ll provide valuable tax-saving recommendations along the way.

Seeking Expertise in Income Tax Return Filing Consult in Amreli?

Income Tax Return Filing Assistance in Amreli

Seeking expert guidance on Income Tax Return Filing Assistance in Amreli? As the city sees a steady increase in tax returns and taxpayers yearly, it has become a thriving hub. With a growing number of startups and businesses, Amreli also witnesses a rise in salaried individuals. Given this dynamic landscape, the meticulous process of Income Tax Return Filing has become essential for individuals and businesses in Amreli, as well as nearby areas like Junagadh, Rajkot, Chikhli, Bhavnagar, Rajula, and others. Hence, filing Income Tax Returns for salaried professionals, business firms, and companies is a critical task in Amreli. Contact our experienced team at ‘ITR Filing Consultant in Amreli’ for tailored assistance

In Amreli, taxpayers come from various sectors, including salaried individuals, small businesses, large corporations, stock market investors, and F&O traders. Moreover, residents hold income from both government and private employment. Acknowledging this diversity, our team in Amreli consists of skilled Chartered Accountants (CAs) and Tax Lawyers well-versed in Income Tax Filing processes.

We provide a comprehensive range of Income Tax Services, specializing in tailored ITR filing and tax planning for taxpayers in Amreli. Leveraging our expertise, our goal is to streamline the Income Tax filing process for individuals and entities in Amreli, ensuring compliance while offering valuable tax-saving strategies.

File Your ITR in Amreli with Expedited Service - Completed in One Day

Would you like to inquire and connect with our specialized tax expert in Amreli? Feel free to send us your documents for ITR filing in Amreli, and we’ll assist you promptly.

Our team in Amreli will prepare a draft income tax return, compute your income, and calculate taxes based on the details provided.

Our dedicated Chartered Accountant for Amreli ITR will review the draft ITR and computation of income. Based on their suggestions, we will share the final draft with you.

Once finalized, we will submit the ITR for our Amreli client. Additionally, we will provide CA certified ITR and computation of income (COI) through doorstep delivery in Amreli.

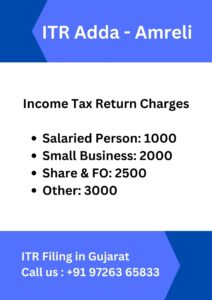

Cost for getting help with filing income taxes in Amreli

Fees for ITR Filing Consultant in Amreli

- Wage Refund – Someone with a job in Amreli: Rs. 1000

- Stocks & Profit from Investments: Rs. 2500

- Income Tax Filing for Small Businesses in Amreli: Rs. 2000

- Income Tax Filing for Partnership Firm or LLP in Amreli: Rs. 3000

- Filing Taxes for a Company: Rs. 3000

- Income Tax Filing for a Trust: Rs. 5000

- Chartered Accountant – Tax Check for Clients in Amreli (if Needed): Starting at Rs. 10,000/-

Documentation Necessary for Income Tax Filing in Amreli

When you want to file your income taxes in Amreli, you need certain documents depending on your job

- For employees: Form 16

- For small business owners: Bank statements

- For capital gains: Bank statements, details of other income, and information about property sold

- For futures and options (F&O) trading or stock trading: Bank statements, profit and loss statement for F&O, and capital gains tax report

- For medium to large businesses: Accounting books, GST turnover, and records of sales and purchases

- For tax deductions and investment details: Information about investments and documents related to deductions under section 80C

In addition to the documents mentioned above, we also require your PAN card, Aadhar card, and bank details if you’re filing your income tax return for the first time.

Click here to see the full list of documents needed for filing your income tax return

Types of Tax Returns for Individuals, Firms, and Companies in Amreli

Let’s Look at the Tax Forms for People, Companies, and Firms in Amreli

- ITR-1: For people in Amreli with salary and interest income up to 50 lakhs.

- ITR-2: For individuals or HUFs in Amreli with income from capital gains/loss on property, investments in shares and mutual funds, agriculture income, etc. Business owners cannot use ITR-2.

- ITR-3: For Amreli businessmen with income from business or profession.

- ITR-4: For Amreli-based businesses choosing presumptive taxation (lump sum).

- ITR-5: For partnership firms and LLPs.

- ITR-6: For companies in Amreli, such as Pvt Ltd, Limited, Section 8, etc.

Income Tax Filing Assistance for Salary Earners in Amreli

If you’re a salaried individual in Amreli looking for assistance with filing your income tax, look no further. At ITR Adda, we specialize in providing income tax filing assistance tailored specifically for salary earners in Amreli. Our services are designed to make the process smooth and hassle-free for you. Whether you’re filing for the first time or need help maximizing your refunds, our team is here to support you every step of the way. With our expertise and personalized approach, you can rest assured that your tax filing needs are in good hands. Let us take the stress out of tax season so you can focus on what matters most to you.

When you’re filing your income tax return as a salaried person, a big choice is picking the tax system. The government offers two: the Old Income Tax System and the New Default Tax System. We’ll look at both options based on your specific situation. At ITR Adda, we provide income tax filing assistance for salary earners in Amreli, ensuring you have the support you need to make the right decision.

Contact our Chartered Accountant for tax filing help in Amreli. Just share your salary details or Form 16 for this year, and we’ll file your taxes within an hour.

Advantages of Filing Income Taxes in Amreli

In Amreli City, filing your Income Tax Return (ITR) on time has many benefits. It helps you follow the rules, avoiding fines and extra charges, which shows you’re responsible with your money and taxes. In Amreli’s busy economy, having your ITR filed can make it easier to get loans approved and increase your chances of getting a visa. Plus, filing your ITR might mean you get some money back from taxes you’ve already paid, which can help with your finances. Also, in Amreli, some government programs are based on your income, so having your ITR filed can prove your income and help you qualify for these programs. Seeking expertise in income tax return filing consult in Amreli? Look no further. Our team of experienced professionals is here to help you every step of the way.

Professional Income Tax Notice Response Service in Amreli

If you’ve received an Income Tax Notice in Amreli, rest assured that our professional Income Tax Notice Response Service is available to assist you. Our team of experts possesses in-depth knowledge of tax regulations and will manage the process of responding to the notice on your behalf. We will meticulously analyze the specifics of the notice, collect requisite information, and ensure that all matters are resolved accurately and efficiently. With our assistance, you can trust that your tax notice will be handled with precision and diligence, allowing you to focus on other aspects of your affairs with peace of mind.

Income Tax Audit Service in Amreli

Discover our professional Income Tax Audit Service in Amreli, where our seasoned team, led by experienced Chartered Accountants, adeptly navigates the intricacies of income tax compliance. Confronting an audit? Our specialists guarantee a seamless process, methodically scrutinizing your financial records and resolving any potential concerns. With our all-encompassing service, bolstered by the proficiency of Chartered Accountants, we deliver assurance, enabling you to concentrate on your core operations while entrusting us with your tax affairs. Rely on our expertise to shepherd you through the audit procedure with efficiency and efficacy.

- Turnover exceeding One Crore //OR//

- Profit is below 6 percent or 8 percent

For professionals, a tax audit is mandated if gross receipts exceed 50 Lakhs or if the profit is below 50 percent.

ITR Adda's Office in Amreli and Nearby Districts

ITR Adda Office – Coming Soon Near Amreli Location

Station Road, Manekpara, Amreli – 365601

We also offer ITR filing services in the district of Amreli, Junagadh, Rajkot, Bhavnagar, Gir Somnath and other nearby District. This includes cities like Amreli, Tower Road, Lal Bungalow, Nagar Palika Market, Lathi Road, Manekpara, Vadi.