ITR Filing Consultant in Anand

Seeking expert help with your income tax return (ITR) filing in Anand? You’re in the right place! Our team of skilled Chartered Accountants and tax advisors, located in Anand, offers smooth ITR filing services. With our knowledge, we ensure a hassle-free process. Our Anand consultants will carefully prepare your draft ITR and calculate your income (COI) using documents you provide, AIS, TIS, and 26AS. Once approved by you, we will swiftly file your online income tax return. Additionally, we offer valuable tax-saving suggestions to optimize your tax responsibilities. Count on our professional team for all your ITR filing needs in Anand.

Need help with ITR filing from a CA based in Anand

Professional Income Tax Filing Solutions in Anand

Are you in need of expert assistance for filing your Income Tax Returns in Anand? With Anand emerging as a thriving center for businesses, notably renowned as the Diamond City, the demand for professional guidance in Income Tax filing continues to rise. As the city witnesses a steady increase in taxpayers and Income Tax Returns annually, navigating the complexities of tax laws becomes essential. At our firm, we provide tailored Income Tax Filing Solutions in Anand to meet the unique requirements of both individuals and businesses. Our customized services are designed to adapt to the evolving landscape of startups and enterprises, ensuring seamless compliance and maximum returns.

In Anand, taxpayers encompass a diverse range, including salaried professionals, business owners, and investors. Acknowledging this diverse landscape, our firm offers Professional Income Tax Filing Solutions in Anand, ensuring meticulous attention to detail and adherence to tax regulations for every client.

We are your one-stop destination for Income Tax Services, offering a comprehensive range of services, from precise ITR filing to strategic tax planning specifically designed for Anand-based taxpayers. Through our expertise and dedication, we aim to simplify the Income Tax filing process for individuals and entities in Anand, ensuring strict compliance while providing invaluable tax-saving advice. Our commitment to excellence is evident in our tailored Income Tax Filing Solutions in Anand, tailored to cater to the diverse needs of our clients.

Accelerated Income Tax Return Submission - Completed in Only 1 Day

Connect with our Anand tax expert for inquiries and ITR filing. Submit your documents for professional solutions tailored for Anand.

Our Anand Team Drafting ITR, Computing Income, Tax Calculation. Professional Solutions.

Anand CA reviews ITR & COI, provides suggestions for final draft.

After finalization, we submit ITR for Anand clients. CA-certified ITR & COI delivered to your doorstep in Anand.

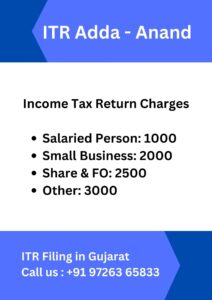

Anand consultancy charges for Income Tax Return filing

Pricing for ITR Filing Consultants in Anand

- Salary Return for Individuals Employed in Anand: Rs. 1000

- Shares & Capital Gains Return Service: Rs. 2500.

- Income Tax Filing for Small Businesses in Anand: Rs. 2000

- Income Tax Filing for Partnership Firms / LLPs in Anand: Rs. 3000

- Company ITR : Rs. 3000

- Income Tax Filing for Trusts: Rs. 5000

- Chartered Accountant – Tax Audit for Clients in Anand(if Necessary): Starting from Rs. 10,000/-

Essential Documentation for Income Tax Filing in Anand

When Choosing to File Income Tax Returns in Anand, Occupation-Based Documentation Needed.

- Employee with Salary Income – Form 16

- Business Entity – Bank Statements

- Profit from Investments – Banking Records, Additional Revenue Information, and Property Sale Particulars

- Futures & Options Turnover or Stock Market Activity – Bank Statement, Profit/Loss Account for Futures & Options, Capital Gain Tax Documentation

- Substantial Business Entity – Financial Ledgers, GST Turnover Data, Sales and Procurement Records, and other relevant documentation

- Tax-saving Investments and Deduction Particulars under Section 80C

Additionally, PAN, Aadhar Card, and Bank Account Details are required for individuals filing their Income Tax Returns for the first time.

Access the Entire Document Checklist for Income Tax Return Filing – Click Here

Selection of ITR Forms for Anand Individuals, Firms, and Companies for Return Filing

Let’s Explore the Suitable ITR Form for Anand Residents, Companies, and Firms at Anand Address.

- Income Tax Return Form 1: Salary and Interest Earnings in Anand (Within 50 lakhs)

- ITR-2: Capital Gains/Losses on Anand Property, Shares, Mutual Funds, Agricultural Income for Individuals or HUFs. Not for those with Business/Professional Income

- ITR-2: Capital Gains/Losses from Anand Property, Shares, Mutual Funds, Agricultural Income for Individuals or HUFs. Excludes Business/Professional Income.

- Anand-Based Businesses Opting for Presumptive Taxation (Fixed Lump Sum).

- Income Tax Return Form 5: Suitable for Partnerships and Limited Liability Partnerships (LLPs).

- ITR-6: Designed for Companies (Private Limited, Limited, Section 8, etc.) Registered in Anand.

Considering Salary Income Tax Return Filing Support in Anand?

Need to file your Income Tax Return for salary? At our firm, ITR Solutions, we offer budget-friendly packages for individuals in Anand, starting at just Rs. 500/-. Furthermore, our advisors can assist you in claiming TDS refunds from the Anand Income Tax Department. Explore our professional tax filing services today.

An important decision when filing your Income Tax Return as a salaried individual is selecting the right tax regime. The government provides two options: the Old Income Tax Regime and the New Tax Regime (Default). At our consultancy in Anand, we carefully assess both regimes based on your specific data to offer personalized recommendations.

Connect with our Chartered Accountant for expert advice on ITR filing in Anand. Simply provide us with your salary details or Form 16 for the current financial year, and we’ll swiftly handle your ITR filing.

Advantages of Income Tax Return Services in Anand

In Anand City, timely submission of Income Tax Returns (ITR) offers several significant benefits. Firstly, it ensures adherence to regulations, shielding individuals and businesses from fines and interest charges. This not only promotes financial responsibility but also strengthens accountability in tax affairs. In the flourishing economic environment of Anand, submitted ITRs play a pivotal role in facilitating smooth loan approval procedures for different types of financing. Additionally, it improves the likelihood of visa approvals, as international embassies frequently examine tax compliance. ITR submission also creates opportunities for potential tax rebates, contributing to overall financial health. Furthermore, in a city where government initiatives are income-dependent, submitted ITRs serve as valid documentation, enabling residents to access benefits under various programs, rendering it a crucial credential for authentication.

Effectively addressing Income Tax Notices in Anand

Received an Income Tax Notice in Anand? Don’t fret! Our Income Tax Notice Response Service, offered by our skilled team at Anand Tax Advisory, is here to support you. We are well-versed in tax laws and will manage the notice response for you. Our professionals will carefully review the notice, gather required details, and ensure prompt resolution. With us handling the tax notice, you can rest assured knowing it’s in capable hands.

Compliance with Income Tax Audit Service in Anand

Explore the expertise of our Income Tax Audit Service in Anand, where our dedicated team, led by experienced Chartered Accountants, simplifies the complexities of income tax compliance. Whether you’re currently undergoing an audit, our specialists ensure a seamless process by carefully examining your financial records and addressing potential issues. Our comprehensive service, supported by the proficiency of Chartered Accountants, provides peace of mind, allowing you to focus on your core activities while we manage your tax affairs accurately. Rely on us to guide you through the audit efficiently and effectively. Furthermore, if you’re in need of an ITR Filing Consultant in Anand, we offer professional assistance to ensure smooth and precise filing, aligning with our commitment to expert financial services.

Businesses requiring a CA tax audit:

- Business revenue exceeding One Crore //OR//

- Profit percentage is less than 6 or 8 percent

Professionals are obligated to undergo a mandatory tax audit if their gross receipts exceed 50 Lakhs or if the profit is below 50 percent.

Anand and the Surrounding District Offices

Coming Soon: ITR Hub in Vicinity of Anand

Bakrol Gate, Vadtal Road, Bakrol, Anand – 388315

Additionally, our ITR filing services extend to the districts Kheda, Ahmedabad, Bharuch, Panchmahal and encompassing cities such as Anand, Vallabh Vidyanagar, Karamsad, Borsad, Petlad, Sojitra, Anklav, Umreth, Tarapur and Khambhat as well asKheda, Ahmedabad, Bharuch, Panchmahal and more.