ITR Filing Consultant in Aravalli

Looking for professional assistance with your income tax return filing in Aravalli? Your search ends here. Aravalli, a team of experienced Chartered Accountants (CAs) and tax consultants based in Aravalli, offers seamless ITR filing services. Enjoy swift and hassle-free ITR filing with us. Our expert team in Aravalli will carefully prepare a draft ITR and computation of income (COI) based on your documents, AIS, TIS, and 26AS. Once approved by you, we will promptly file your online income tax return. Additionally, we provide valuable tax-saving suggestions to optimize your financial strategy. Trust Aravalli for comprehensive tax solutions tailored to your requirements.

Require assistance with ITR filing in Aravalli

Expert Income Tax Filing Service in Aravalli

Seeking expert assistance with ITR filing in Aravalli? Given the city’s growing number of Income Tax Returns and flourishing startup ecosystem, precise filing is essential. Our Professional Income Tax Filing Service in Aravalli caters to individuals and businesses across Aravalli, Bardoli, Navsari, Chikhli, Vyara, and surrounding areas, ensuring a smooth process for all.

In Aravalli, taxpayers encompass various categories, including salaried individuals, small business owners, large corporations, stock market investors, and F&O traders. Moreover, individuals in Aravalli earn income from both government and private jobs. Acknowledging this diverse landscape, our team comprises skilled Chartered Accountants (CAs) and Tax Lawyers with extensive experience in Income Tax Filing. Avail of our Professional Income Tax Filing Service in Aravalli for accurate and efficient filing tailored to your unique requirements.

We provide a comprehensive solution for Income Tax Services, offering thorough ITR filing and customized tax planning services tailored specifically for Aravalli taxpayers. Leveraging our expertise, our goal is to simplify the Income Tax filing process for individuals and entities in Aravalli, ensuring compliance with regulations and providing strategic tax-saving advice.

Quick Income Tax Return Filing in Aravalli - Completed in a Day

Start an Inquiry and Reach Out to Our Dedicated Tax Specialist in Aravalli. Provide Your Documents for ITR Filing Assistance in Aravalli.

Our team in Aravalli will carefully prepare your Income Tax Return, conduct a detailed income computation, and calculate taxes using the information you provide.

Our assigned Chartered Accountant for Aravalli ITR will examine the draft ITR and COI. Following their advice, we’ll present the final draft for your approval.

After finalizing, we proceed to submit the ITR for our clients in Aravalli and provide doorstep delivery of CA-certified ITR and COI documents within the city.

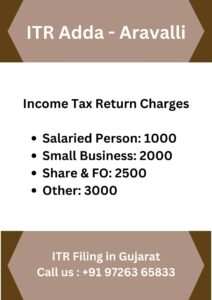

Pricing for Income Tax Return Filing Consultancy in Aravalli

Pricing for ITR Filing Assistance in Aravalli:

- Salary Income Tax Return for Aravalli Employees: Rs. 1000

- Capital Gains & Shares Return Service: Rs. 2500

- Small Business Tax Return Service in Aravalli: Rs. 2000

- Partnership Firm or LLP Tax Return Service in Aravalli: Rs. 2000

- Company Tax Return Service in Aravalli: Rs. 3000

- Trust Tax Return Service in Aravalli: Rs. 5000

- CA Services – Tax Audit for Clients in Aravalli (if Required): Starting at Rs. 10,000/

Required Documents for Income Tax Filing in Aravalli

When Opting for Income Tax Return Filing in Aravalli, Specific Documents Are Necessary Depending on Your Occupation:

Salaried Individual – Form 16

Small Business Owner – Bank Statements

Income from Capital Gains – Bank Statements, Other Income Details, Property Sale Transactions

Derivatives or Stock Trading – Bank Statements, Profit/Loss Statements, Capital Gains Report

Established Business – Financial Statements, GST Turnover, Sales and Purchase Records, etc.

Investment Details for Tax Deductions under Section 80C

Additionally, PAN, Aadhar Card, and Banking Details are required for First-time Filers.

For a Complete Checklist of Documents for Income Tax Return Filing, Click Here

Different forms for filing tax returns by individuals, businesses, and companies located in Aravalli.

Find the Right Tax Form for Residents, Businesses, and Companies in Aravalli.

ITR-1: For Aravalli-based individuals with salary and interest earnings (up to 50 lakhs).

ITR-2: For capital gains or losses from Aravalli property, shares, mutual funds, agricultural income, etc., applicable to individuals or HUFs. Not for individuals with business or professional income.

ITR-3: Suitable for Aravalli-based business owners with income from business activities and professional work.

ITR-4: For Aravalli businesses opting for the presumptive taxation (fixed sum) scheme.

ITR-5: Designed for partnership firms and LLPs in Aravalli.

ITR-6: Applicable to companies (private limited, limited, section 8, etc.) located in Aravalli.

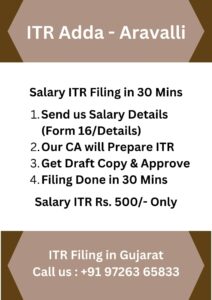

Income Tax Filing Assistance for Salary Earners in Aravalli

Looking to file your Salary Income Tax Return (ITR)? At ITR Help Desk, we have affordable packages starting at just Rs. 500/- specifically designed for Salaried Individuals in Aravalli. Our advisors also assist in claiming TDS refunds from the Income Tax Department in Aravalli.

Choosing the right tax regime is crucial for Salaried Individuals when filing their Income Tax Returns. The government offers two options: the Old Income Tax Regime and the New Tax Regime (Default). We analyze both regimes thoroughly based on your personalized data to determine the best option for you.

Contact our Chartered Accountant for expert ITR Filing Advice in Aravalli. Just share your salary details or Form 16 for the current financial year, and we’ll expedite the filing process, ensuring completion within hours.

Benefits of Filing Income Tax Returns in Aravalli

In Aravalli City, filing your Income Tax Returns (ITR) on time brings several significant benefits. Firstly, it ensures compliance with tax laws, protecting individuals and businesses from fines and interest charges. This not only encourages wise financial management but also demonstrates a commitment to following tax rules. In Aravalli’s thriving economy, submitted ITRs play a crucial role in speeding up the approval process for various types of loans. Additionally, they enhance the chances of visa approval, as foreign embassies often review tax compliance records. Moreover, filing ITRs opens up the possibility of receiving tax refunds, strengthening overall financial security. Furthermore, in a city where government initiatives depend on income criteria, filed ITRs serve as important documentation, allowing residents to access benefits under various schemes and serving as vital validation documents.

Income Tax Notification Support in Aravalli

If you’ve received an Income Tax Notice in Aravalli, don’t worry. Our Income Tax Notice Response Service is here to help. Our team of experienced professionals knows tax laws inside and out, ensuring careful handling of your notice. We’ll review the details, collect required information, and make sure everything is addressed correctly. With our support, you can trust that your tax notice will be handled effectively, easing any worries or stress you may have.

Income Tax Audit Assistance in Aravalli

Discover our Income Tax Audit Support in Aravalli, where our team, led by experienced Chartered Accountants, simplifies income tax compliance complexities. Dealing with an audit? Our experts ensure a seamless process, meticulously reviewing your financial records and addressing any potential issues. With our all-inclusive service, including the expertise of Chartered Accountants, we provide reassurance, allowing you to concentrate on your core activities while we handle your tax matters accurately. Count on us to efficiently and effectively navigate you through the audit process.

Chartered Accountant’s Tax Audit is required for businesses meeting either of the following criteria:

Turnover exceeding One Crore //OR// Net income falling below 6 percent or 8 percent

For professional individuals, a tax audit is obligatory when gross receipts exceed 50 Lakhs or profit falls below 50 percent.

Income Tax Return Services Office in Aravalli and Nearby Districts

Soon to Open: ITR Adda in Proximity to Aravalli

Amiyapur, Bayad, Aravalli – 383325

We also offer Income Tax Return (ITR) filing services across various districts, including Aravalli, Sabarkantha, Kheda, Mahisagar, Gandhinagar. Mehsana, and others. This encompasses cities such as Aravalli, Modasa, Malpur, Dhansura, Meghraj and more.