ITR Filing Consultant in Dang

Seeking an Income Tax Filing Consultant in Dang? Look no further! We’re a group of Chartered Accountants (CAs) and tax advisors situated in Dang, providing straightforward income tax return filing services. Our seasoned consultants will take care of all the details for you. We’ll create a draft ITR and income computation using your documents, AIS, TIS, and 26AS. Upon your approval, we’ll promptly submit your income tax return online. Additionally, we’ll offer helpful tax-saving tips throughout the process.

Searching for an Expert to Help with Income Tax Returns in Dang

Income Tax Return Filing Service in Dang

Seeking assistance with income tax return filings in Dang? As the number of taxpayers increases annually, it’s crucial to manage tax filings accurately, especially with the growing business landscape. Whether you’re a salaried individual, a small business owner, or part of a larger corporation, our team of skilled Chartered Accountants and Tax Lawyers is ready to support you.

Dang boasts a diverse taxpayer base, including government and private job earners, as well as stock market participants and traders. Understanding this diversity, we provide customized income tax services tailored to your requirements. Our aim is to simplify the filing process, ensure compliance, and offer valuable tax-saving advice. Whether you’re in Dang or neighboring areas like Dang, Bardoli, Navsari, Chikhli, or Vyara, we’re dedicated to guiding you through your income tax obligations.

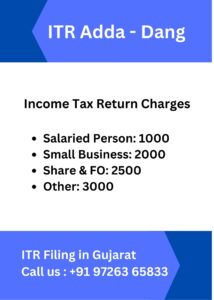

Charges for Income Tax Return Filing Consultancy in Dang

Here are our charges for assisting with income tax returns in Dang:

- Individuals with a job in Dang: Rs. 1000

- Income from shares and capital gains: Rs. 2500

- Small businesses in Dang: Rs. 2000

- Partnership firms or LLPs in Dang: Rs. 3000

- Companies in Dang: Rs. 3000

- Trusts: Rs. 5000

- Tax audit services by a Chartered Accountant for Dang clients (if needed): Starting from Rs. 10,000

Documents Required for Filing Income Tax in Dang

When filing your income tax return in Dang, you’ll need specific documents depending on your occupation:

- Salaried Individual – Form 16 from your employer.

- Small Business Owner – Bank statements showing business transactions.

- Capital Gains – Bank statements, details of other income, and information on property sales.

- Futures & Options Trading or Share Trading – Bank statements, profit and loss account for F&O, and capital gains tax report.

- Medium to Large Business Owner – Maintain books of accounts, records of GST turnover, sales, and purchase records.

- Details of Deductions under Section 80C and other tax-saving investments.

Additionally, you’ll need your PAN card, Aadhar card, and bank details if you’re filing your tax return for the first time.

For a comprehensive list of documents required for ITR filing, please click here.

Types of Income Tax Returns (ITRs) for filing in Dang for individuals, firms, and companies

Let’s explore the different ITR forms for citizens, companies, and firms registered in Dang:

- ITR-1: For Dang residents with salary and interest income (up to 50 lakhs).

- ITR-2: For individuals or HUFs with income from capital gains/loss on property in Dang, investments in shares and mutual funds, agriculture income, etc. Business and professional income individuals cannot use ITR-2.

- ITR-3: Suitable for businessmen in Dang with business and professional income.

- ITR-4: For businesses based in Dang opting for presumptive taxation (lumpsum).

- ITR-5: Applicable for partnership firms and LLPs in Dang.

- ITR-6: For companies based in Dang (Private Ltd., Limited, Section 8, etc.)

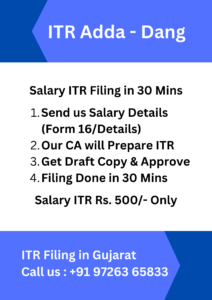

Salary Income Tax Return Filing Advisor in Dang

Are you looking to file your salary income tax return? At ITR Adda, we offer budget-friendly packages starting from just Rs. 500 for Dang’s salaried individuals. Our advisors can also assist you in claiming TDS refunds from the Dang Income Tax Department.

When filing your tax return, it’s essential to decide between the Old Income Tax Regime and the New Tax Regime (default). We’ll analyze both options based on your personalized data to help you make the right choice.

Reach out to our Chartered Accountant for tax filing consultancy in Dang. Just provide us with your salary details or Form 16 for this financial year, and we’ll ensure your tax return is filed promptly.

Advantages of Income Tax Return Filing in Dang

In Dang City, timely filing of Income Tax Returns (ITR) offers numerous benefits. Firstly, it ensures adherence to tax regulations, protecting individuals and businesses from fines and interest charges. This not only encourages financial responsibility but also strengthens accountability regarding taxes. In Dang’s dynamic economic environment, filed ITRs play a vital role in facilitating smooth approval processes for different types of loans. Additionally, it improves the chances of visa approval, as foreign embassies often review tax compliance records. ITR filing also creates opportunities for potential tax refunds, contributing to overall financial stability. Furthermore, in a city where government schemes are tied to income levels, filed ITRs serve as valid proof, enabling residents to access benefits under various schemes, making it an essential document for verification.

Income Tax Notice Response Assistance in Dang

If you’ve received an Income Tax Notice in Dang, no need to fret! Our Income Tax Notice Response Service is available to assist you. Our team of experts knows the ins and outs of tax regulations, and they’ll handle the notice on your behalf. They’ll review the notice, collect necessary information, and ensure everything is addressed correctly. With us taking care of it, you can rest easy and leave the tax notice worries to us!

Income Tax Audit Assistance in Dang

Discover our Income Tax Audit Assistance in Dang, where our team, led by experienced financial experts, simplifies the complexities of income tax compliance. Facing an audit? Our experts ensure a smooth process, carefully examining your financial records and addressing potential issues. With our comprehensive service, including the expertise of financial professionals, we provide peace of mind, allowing you to focus on your core activities while we handle your tax matters accurately. Trust us to guide you through the audit process efficiently and effectively.

Tax Audit Required for Businesses if:

- Turnover exceeds One Crore //OR//

- Profit is below 6 Percent or 8 Percent

For Professionals, Tax Audit is Required if:

- Gross Receipts exceed 50 Lakhs //OR//

- Profit is below 50 Percent.

Dang & Nearby District Office - ITR Corner

ITR Adda Office – Near Dang Location (Open )

SV Desai Marg, University Area, Dang 394710

Also We are Providing ITR Filing Service in District of, Navsari, Valsad, Tapi, Narmada, Bharuch, Surat, etc.