ITR Filing Consultant in Devbhumi Dwarka

Need help with filing your income tax returns in Devbhumi Dwarka? We’ve got you covered! Our team of Chartered Accountants (CAs) and tax consultants in Devbhumi Dwarka provides seamless ITR filing services. We’ll prepare your draft ITR and income computation based on your documents and submit it online upon your approval. Plus, we’ll offer advice on tax-saving strategies to optimize your benefits.

Need an ITR Filing Consultant/CA in Devbhumi Dwarka?

Income Tax Return Filing Assistance in Devbhumi Dwarka

Need assistance with Income Tax Return filing in Devbhumi Dwarka? With the region’s growing economy and increasing number of taxpayers annually, filing taxes has become essential for individuals and businesses alike. Whether you’re a salaried professional or a business owner in areas like Bardoli, Navsari, Chikhli, and Vyara, we’re here to help you with your tax filing needs.

“In Devbhumi Dwarka, various individuals pay taxes, including salary earners, small business owners, employees of large corporations, stock market investors, and futures and options traders. Residents also earn income from both government and private jobs. To assist everyone with their tax obligations, we have a team of expert Chartered Accountants (CAs) and Tax Lawyers well-versed in Income Tax Returns (ITRs).

We provide comprehensive tax services, including ITR filing and tax planning, all under one roof. Our aim is to simplify the tax filing process for individuals and businesses in Devbhumi Dwarka, ensuring compliance with regulations and maximizing tax savings.

Quick ITR Filing Service in Devbhumi Dwarka

Get in touch with our dedicated tax specialist in Devbhumi Dwarka. Simply send us your documents for Income Tax Return filing in Devbhumi Dwarka.

Our team in Devbhumi Dwarka will create a draft of your Income Tax Return, calculate your income, and determine your taxes based on the information provided.

Our Chartered Accountant specializing in Devbhumi Dwarka ITR will review the draft ITR and COI. We’ll then share the final draft with you based on their recommendations.

After finalizing, we’ll submit the ITR for our Devbhumi Dwarka clients. Additionally, we’ll provide CA-certified ITR and COI with doorstep delivery in Devbhumi Dwarka.

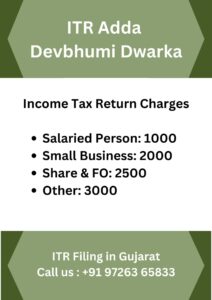

Charges for Income Tax Return Filing Service in Devbhumi Dwarka

Essential Records for Income Tax Lodgement in Devbhumi Dwarka

When filing Income Tax Returns in Devbhumi Dwarka, you’ll need these documents based on your occupation:

- Salaried Person: Form 16

- Small Business: Bank Statement

- Capital Gain: Bank Statement, Other Income Details, Selling of Property Details

- F&O Turnover or Share Trading: Bank Statement, F&O Profit and Loss Account, Capital Gain Tax Report

- Medium to Large Business: Books of Account, GST Turnover, Sales and Purchase Records, etc.

- Deduction 80C and Investment Details for Tax Purpose

Additionally, for first-time filers, PAN, Aadhar Card, and Bank Details are required.

Get the complete list of documents for ITR Filing – Click Here

Assortment of ITRs for Tax Compliance in Devbhumi Dwarka: Individuals, Businesses, Entities

Let’s look at the different ITR forms for residents, companies, and firms inDevbhumi Dwarka:

ITR-1: For individuals with salary and interest income in Devbhumi Dwarka(up to 50 lakhs).

ITR-2: For individuals or HUFs with income from capital gains/loss on Devbhumi Dwarka property, investments in shares and mutual funds, agriculture income, etc. Those with business and professional income cannot use this form.

ITR-3: Suitable for Devbhumi Dwarka-based businessmen with business and professional income.

ITR-4: For Devbhumi Dwarka-based businesses opting for presumptive taxation (lump sum).

ITR-5: Applicable for partnership firms and LLPs.

ITR-6: Designed for companies located in Devbhumi Dwarka(Pvt Ltd, Limited, Section 8, etc).

Income Tax Filing Help for Salary Earners in Devbhumi Dwarka

If you’re looking to file your salary income tax return, our team at ITR Hub offers budget-friendly packages in Devbhumi Dwarka, starting at just Rs. 500. Additionally, our advisor can help you claim TDS refunds from the Income Tax Department in Devbhumi Dwarka.

When filing your income tax return as a salaried individual, it’s crucial to choose between the Old Income Tax Regime and the New Tax Regime. Our experts analyze both options based on your specific data to assist you in making the right decision.

Get in touch with our Chartered Accountant (CA) for expert assistance with filing your ITR in Devbhumi Dwarka. Just send us your salary details or Form 16 for this financial year, and we’ll ensure your ITR is filed promptly.

Advantages of Submitting Income Tax Returns in Devbhumi Dwarka

In Devbhumi Dwarka, submitting your Income Tax Return (ITR) on schedule offers several key advantages. Firstly, it ensures compliance with tax laws, averting penalties and interest fees. This demonstrates financial responsibility and respect for tax obligations. Additionally, timely ITR filing can facilitate loan approvals and boost visa application success, as foreign embassies often review tax compliance. Furthermore, prompt ITR submission opens doors to potential tax refunds, improving overall financial well-being. Lastly, in a city where government programs hinge on income, a filed ITR serves as crucial documentation, enabling residents to access program benefits. Our team provides expert assistance with Income Tax Return filing in Devbhumi Dwarka, serving as your dependable ITR Filing Consultant.

Income Tax Notices in Devbhumi Dwarka? We've got you covered in Devbhumi Dwarka.

If you get an Income Tax Notice in Devbhumi Dwarka, don’t stress! Our service in Devbhumi Dwarka has it under control. Our specialists know tax regulations and will manage the notice for you. They’ll collect the required details and ensure everything is resolved correctly, allowing you to relax and leave the tax notice to us.

Income Tax Audit Guidance in Devbhumi Dwarka

Explore our Income Tax Audit Support in Devbhumi Dwarka, where our team, led by experienced Chartered Accountants, simplifies income tax compliance. If you’re undergoing an audit, our experts ensure a smooth process by meticulously reviewing your financial records and addressing potential issues. With our comprehensive service, supported by the expertise of Chartered Accountants, we provide peace of mind, allowing you to focus on your core activities while we handle your tax matters accurately. Rely on us to guide you efficiently through the audit process.

For businesses in Devbhumi Dwarka, a Tax Audit is mandatory if:

Turnover exceeds One Crore, or Profit falls below 6% or 8%.

For professionals, a Tax Audit is required if Gross Receipts exceed 50 Lakhs or Profit is less than 50%. Trust us for Income Tax Return Filing Assistance and Consultation in Devbhumi Dwarka.

Devbhumi Dwarka & Nearby Location Office - ITR Depot

ITR Adda Office – Near Devbhumi Dwarka Location ( Soon)

Buildingrailway Station Road Dwarka Devbhoomi Dawarka Gujarat 361335

Also We are Providing ITR Filing Service in District of Jamnagar, Porbandar, Rajkot etc Consist City of Devbhumi Dwarka Khambhalia, Bhanvad,Okhamandal, Kalyanur etc.