ITR Filing Consultant in Guntur

Are you in need of assistance with filing your Income Tax Return (ITR) in Guntur? Look no further! We are a team of Chartered Accountants (CAs) and tax consultants based in Guntur, offering professional income tax return filing services. Experience hassle-free ITR filing services with us. Our Guntur consultancy team will assist you by preparing a draft ITR and computation of income (COI) using your documents, AIS, TIS, and 26AS. Upon your approval, we will proceed to file your online income tax return. Additionally, count on our team to provide you with valuable tax-saving suggestions throughout the process. Our ITR Filing Consultant in Guntur is here to support you every step of the way.

Required For ITR Filing Consultant/CA in Guntur?

Income Tax Return Filing Help in Guntur

Are you seeking professional assistance for filing your Income Tax Returns in Guntur? Guntur, like Guntur, experiences a consistent increase in the number of taxpayers each year, being a bustling hub in the region. The city witnesses rapid growth in startups and businesses, leading to a rise in the number of salaried individuals. With areas like Guntur, Tenali, Narasaraopet, Ponnur, Bapatla, and others witnessing significant economic activity, the meticulous process of Income Tax Return Filing holds paramount importance for individuals and businesses alike. Therefore, whether you’re located in Guntur or nearby areas, filing Income Tax Returns for salaried professionals, business firms, and companies has become an essential task.

Our team of experts, including our ITR Filing Consultant in Guntur and Income Tax Return Filing Help in Guntur, is here to guide you through the entire process.

In Guntur, there are five primary categories of taxpayers, including salaried individuals, small business owners, large corporations, stock market investors, and Futures and Options (F&O) traders. Additionally, individuals in Guntur may earn income from both government and private sector employment. Understanding the diverse taxpayer landscape in Guntur, our team comprises skilled Chartered Accountants (CAs) and Tax Lawyers who specialize in Income Tax Filing.

We offer comprehensive Income Tax services tailored specifically for taxpayers in Guntur, providing seamless ITR filing and personalized tax planning. With our knowledge and experience, we aim to simplify the Income Tax filing process for individuals and businesses in Guntur, ensuring compliance and offering valuable tax-saving recommendations.

ITR Filing in Guntur - One Day Process

Contact our specialized tax expert in Guntur for inquiries. Send us your documents for ITR filing in Guntur.

Our Guntur team will create a preliminary Income Tax Return draft, compute your income, and calculate taxes based on the information provided.

Our Chartered Accountant who specializes in Guntur ITR will review the draft ITR and COI. We’ll then share the final draft with you based on their suggestions.

After finalizing everything, we’ll submit your ITR for clients in Guntur. Additionally, we’ll provide CA-certified ITR and COI delivered to your doorstep in Guntur.

Charges for Income Tax Return Filing Service in Guntur

Charges for ITR Filing Consultant in Guntur:

- Salary Return (Individuals employed in Guntur): Rs. 1000

- Shares & Capital Gain Return: Rs. 2500

- Guntur Small Business ITR: Rs. 2000

- Partnership Firm / LLP in Guntur: Rs. 3000

- Company ITR in Guntur: Rs. 3000

- Trust ITR in Guntur: Rs. 5000

- CA Tax Audit for clients in Guntur (if Required): Starting from Rs. 10,000/-

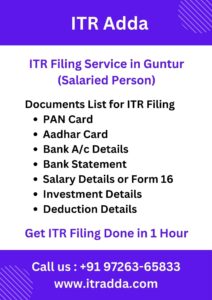

Documents Needed for Income Tax Filing in Guntur

When filing your Income Tax Return in Guntur, you’ll need specific documents based on your occupation:

- For Salaried Individuals: Form 16

- Small Business Owners: Bank Statements

- Capital Gains: Bank Statements, Details of Other Income, and Information on Property Sales

- Futures & Options (F&O) Traders or Share Trading: Bank Statements, F&O Profit and Loss Account, Capital Gain Tax Report

- Medium to Large Businesses: Financial Records including Books of Accounts, GST Turnover, Sales and Purchase Records, etc.

- Details of Deductions under Section 80C and Investment Information for Tax Purposes

Additionally, you’ll need your PAN Card, Aadhar Card, and Bank Details if it’s your first time filing an Income Tax Return.

Various ITRs for Tax Disclosure in Guntur: Individuals, Enterprises, Entities

Let’s take a look at the different Income Tax Return (ITR) forms for residents, companies, and firms registered in Guntur:

ITR-1: For individuals with Salary and Interest Income in Guntur (up to 50 lakhs).

ITR-2: Covers Income from Capital Gains/Loss on Guntur Property, Investments in Shares and Mutual Funds, Agriculture Income, etc., for Individuals or Hindu Undivided Families (HUFs). Individuals with Business and Professional Income cannot use ITR-2.

ITR-3: Suitable for Guntur businessmen with Business and Professional Income.

ITR-4: For Guntur-based businesses opting for Presumptive Taxation (Lumpsum).

ITR-5: Applicable for Partnership Firms and Limited Liability Partnerships (LLPs).

ITR-6: Designed for Companies (Private Limited, Limited, Section 8, etc.) located in Guntur.

Income Tax Return Filing Advisor for Salary Earners in Guntur

Do you need assistance with filing your Income Tax Return (ITR) for your salary income? At ITR Adda, we offer affordable packages for Income Tax Return Filing for Salaried Individuals in Guntur, starting from just Rs. 500/-. Additionally, our advisor will assist you in claiming any TDS refunds from the Income Tax Department in Guntur.

When filing your Income Tax Return as a salaried individual, it’s essential to decide between the two tax regimes offered by the government: the Old Income Tax Regime and the New Tax Regime (Default). We analyze both regimes based on your personalized data to help you make an informed decision.

Connect with our Chartered Accountant (CA) for expert assistance with Income Tax Return Filing in Guntur. Our ITR Filing Consultant in Guntur and Income Tax Return Filing Help in Guntur are here to guide you through the process. Simply send us your salary details or Form 16 for this financial year, and we’ll ensure your ITR is filed promptly.

Gains of Income Tax Return Filing in Guntur

In Guntur City, timely Income Tax Return (ITR) filing offers several important benefits. Firstly, it ensures compliance, protecting individuals and businesses from penalties and interest charges. This promotes financial responsibility and reinforces accountability in tax matters. In Guntur’s vibrant economic landscape, filed ITR plays a crucial role in facilitating smooth loan approval processes for various types of loans. Additionally, it enhances the chances of visa approvals, as foreign embassies often review tax compliance records. ITR filing also creates opportunities for potential tax refunds, which contribute to overall financial well-being. Moreover, in a city where government schemes are income-based, filed ITR serves as valid proof, enabling residents to access benefits under various schemes, making it a key document for validation.

Our ITR Filing Consultant in Guntur and Income Tax Return Filing Help in Guntur are available to assist you with your tax filing needs.

Gains of Income Tax Return Filing in Guntur

If you’ve received an Income Tax Notice in Guntur, no need to worry! Our Income Tax Notice Response Service is here to assist you. We have a team of experts who are well-versed in tax regulations, and they’ll handle the response to the notice on your behalf. They’ll carefully review the details, gather necessary information, and ensure that everything is resolved correctly. With our assistance, you can rest assured that the tax notice is being taken care of efficiently – we’ve got you covered!

Income Tax Audit Consultancy in Guntur

Discover our Income Tax Audit Service in Guntur, where our team, led by experienced Chartered Accountants, simplifies the complexities of income tax compliance. Facing an audit? Our experts ensure a smooth process, carefully examining your financial records and addressing any potential issues that may arise. With our comprehensive service, which includes the expertise of Chartered Accountants, we provide peace of mind, allowing you to focus on your core activities while we handle your tax matters with precision. Trust us to guide you through the audit process efficiently and effectively.

CA Tax Audit is required for businesses meeting the following criteria:

- Turnover exceeding One Crore

- Profit margin less than 6% or 8%

For professionals, Tax Audit is necessary if:

- Gross Receipts exceed 50 Lakhs

- Profit margin is less than 50%

Our ITR Filing Consultant in Guntur and Income Tax Return Filing Help in Guntur are here to assist you every step of the way.

Guntur & Near District Office - ITR Adda

ITR Adda Office – Near Guntur Location (Open)

Opp. KLP School, JKC College Road, Dist. Guntur – 522006

We provide assistance with filing Income Tax Returns (ITR) in Guntur, covering areas like Arundelpet, Brodipet, Lakshmipuram, and other parts of the city.