ITR Filing Consultant in Mahesana

Looking for an Income Tax Filing Consultant in Mahesana? We’re a group of Chartered Accountants (CAs) and tax advisors located in Mahesana, providing easy income tax filing services. Our Mahesana consultancy team will help you by preparing a draft Income Tax Return (ITR) and income computation based on your documents, AIS, TIS, and 26AS. Once you give the green light, we’ll file your income tax return online. Plus, we’ll offer advice on tax-saving techniques.

Interested in ITR Filing Consultant/CA in Mahesana?

Income Tax Return Filing Service in Mahesana

Are you looking for expert help with filing your Income Tax Returns in Mahesana? As the number of taxpayers in Mahesana continues to grow each year, ensuring accurate Income Tax Return filing is essential for individuals and businesses in Mahesana, Bardoli, Navsari, Chikhli, Vyara, and surrounding areas.

In Mahesana, there are five main groups of taxpayers: those who earn a salary, small business owners, large corporations, stock market investors, and F&O traders. Additionally, individuals in Mahesana may have income from both government and private employment.

Understanding the diverse needs of taxpayers in Mahesana, our team consists of experienced Chartered Accountants (CAs) and Tax Lawyers specializing in Income Tax Filing.

We offer comprehensive Income Tax Services in Mahesana, providing tailored ITR filing and tax planning solutions for Mahesana-based taxpayers. Our goal is to simplify the Income Tax filing process and ensure compliance while offering valuable tax-saving advice.

Income Tax Return Filing in Mahesana - Done within a Day

Ask and Get in Touch with Our Tax Expert in Mahesana. Share your papers for filing taxes in Mahesana.

Our team in Mahesana will create an initial Income Tax Return, calculate your income, and assess your taxes based on the information you provide.

Our dedicated Chartered Accountant for Mahesana Income Tax Returns will check the initial ITR and COI. Once reviewed, we’ll send you the final version incorporating their feedback.

After completing, we’ll file the tax return for our client in Mahesana. Additionally, we’ll give you a certified tax return and certificate of incorporation at your Mahesana location.

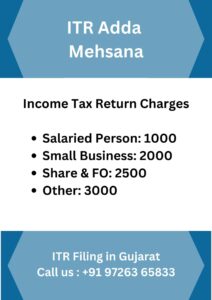

Costs for Assistance with Filing Income Tax Returns in Mahesana

Prices for Help with Filing Income Tax Returns in Mahesana

Individual Salary Tax Return in Mahesana: Rs. 1000

Returns for Stocks & Capital Gains: Rs. 2500

Small Business Tax Returns in Mahesana: Rs. 2000

Partnership Firm / LLP Returns in Mahesana: Rs. 3000

Company Tax Returns in Mahesana: Rs. 3000

Trust Tax Returns in Mahesana: Rs. 5000

Tax Audit Assistance by CA for Mahesana Clients (if Needed): Starting at Rs. 10,000/-

Documents Needed for Filing Income Tax in Mahesana

When Choosing to File Income Tax Returns in Mahesana, Required Documents Based on Occupation are:

- Salaried Person: Form 16

- Small Business: Bank Statements

- Capital Gains: Bank Statements, Details of Other Income, and Property Sale Details

- F&O Trading or Share Trading: Bank Statements, F&O Profit and Loss Account, Capital Gains Tax Report

- Medium to Large Business: Accounting Books, GST Turnover, Sales and Purchase Records, etc.

- Deductions under Section 80C and Investment Details for Tax Purposes

In addition to the above documents, PAN, Aadhar Card, and Bank Details are required if filing ITR for the first time.

For the complete list of documents required for ITR filing, please click here.

Kinds of Tax Returns for Filing by Individuals, Businesses, and Companies in Mahesana

Let’s Explore Different Tax Forms for Mahesana Residents, Companies, and Firms Registered in Mahesana:

Form ITR-1: For Salaries and Interest Earnings in Mahesana (Up to 50 lakhs).

Form ITR-2: For Income from Buying/Selling Property in Mahesana, Investments in Stocks, Mutual Funds, Agriculture Earnings, etc., for Individuals or HUFs. Individuals or HUFs with Business or Professional Income cannot use this form.

Form ITR-3: Suitable for Business and Professional Earnings of Mahesana Business Owners.

Form ITR-4: For Mahesana-based Businesses opting for Presumptive Taxation (Lumpsum).

Form ITR-5: Applicable for Partnership Firms and LLPs in Mahesana.

Form ITR-6: Applicable for Companies in Mahesana (Private Ltd, Limited, Section 8, etc.).

Income Tax Return Filing Advisor for Salary Earners in Mahesana

Are you looking to file your Income Tax Return for your salary? Here at ITR Adda, we provide budget-friendly packages for Salaried Individuals in Mahesana, starting from just Rs. 500/-! Plus, our expert will help you claim any TDS refunds from the Income Tax Department in Mahesana.

When filing your Income Tax Return as a Salaried Person in Mahesana, you’ll need to decide between the Old Income Tax Regime and the New Tax Regime (Default). We’ll analyze both options based on your specific situation.

Get in touch with our Chartered Accountant for assistance with Income Tax Return Filing in Mahesana. Simply share your Salary Details or Form 16 for the current financial year, and we’ll ensure your ITR is filed promptly.

Benefits of Submitting Income Tax Returns in Mahesana

In Mahesana, submitting Income Tax Returns (ITR) on time offers several key advantages. Firstly, it ensures adherence to regulations, shielding individuals and businesses from fines and interest fees. This not only promotes financial responsibility but also reinforces responsibility regarding taxes. In Mahesana’s flourishing economy, filed ITR plays a pivotal role in streamlining loan approval processes for different types of loans. Moreover, it improves the likelihood of visa approval, as foreign embassies frequently review tax compliance records. ITR submission also opens avenues for potential tax refunds, contributing to overall financial health. Furthermore, in a city where government assistance programs are income-dependent, filed ITR serves as credible evidence, enabling residents to access benefits under various programs, making it an essential document for authentication.

Income Tax Notice Response Service in Mahesana

If you’ve got an Income Tax Notice in Mahesana, no need to fret! Our Income Tax Notice Assistance Service is here to lend a hand. Our experienced team understands tax laws thoroughly and will handle the notice response on your behalf. They’ll examine the specifics, gather required details, and ensure everything is addressed accurately. With us handling the tax notice, you can rest assured it’s in good hands! Plus, we also provide Income Tax Return Filing Assistance in Mahesana for added convenience.

Income Tax Audit Assistance in Mahesana

Explore our Income Tax Audit Support in Mahesana, where our skilled team, led by Chartered Accountants, simplifies the complexities of income tax compliance. If you’re facing an audit, our experts ensure a smooth process by thoroughly reviewing your financial records and addressing any potential issues. With our all-inclusive service, including the expertise of Chartered Accountants, we provide peace of mind, allowing you to concentrate on your primary activities while we handle your tax matters accurately. You can rely on us to navigate the audit process efficiently and effectively.

Tax audits are mandatory for businesses in Mahesana if their turnover exceeds one crore rupees or if their profit margin is below 6-8 percent. Professionals also need a tax audit if their gross receipts exceed 50 lakhs or if their profit margin is below 50 percent. Additionally, we offer Income Tax Return Filing Assistance in Mahesana for your convenience.

Mahesana & Nearby District Office - ITR Hub

ITR Adda Office – Near Mahesana Location ( Soon)

Laxmi Nivas, Rajmahal Road, PB No. 3, Mehsana – 384001.

Also We are Providing ITR Filing Service in District of Sabarkantha, Patan, Gandhinagar etc Consist City of Visnagar, Choryasi, Olpad, Mangrol, Kadi, Unjha, Visapur, Modhera, Kheralu, Bechraji etc.