ITR Filing Consultant in Mahisagar

Looking for assistance with filing your income tax return in Mahisagar? We’re a team of Chartered Accountants (CAs) and tax consultants based in Mahisagar, providing hassle-free income tax return filing services. Get your ITR filed quickly and effortlessly. Our Mahisagar consultancy team will prepare a draft ITR and income computation based on your documents, AIS, TIS, and 26AS. Once you give the green light, we’ll file your income tax return online for you. Plus, our team will offer suggestions on how to save taxes.

Looking for an ITR filing consultant/CA in Mahisagar?

Income Tax Return Assistance in Mahisagar

Seeking expert assistance with Income Tax Return filing in Mahisagar? With a growing number of taxpayers each year, accurate filing is crucial. In Mahisagar, including Bardoli, Navsari, Chikhli, Vyara, and nearby areas, filing Income Tax Returns for salaried professionals, businesses, and companies is vital.

Taxpayers in Mahisagar include salaried individuals, small businesses, large corporations, stock market participants, and F&O traders. Our team of professional Chartered Accountants (CAs) and Tax Lawyers specializes in Income Tax Filing in Mahisagar, offering tailored services. We provide comprehensive ITR filing and tax planning solutions for Mahisagar-based taxpayers to ensure compliance and offer valuable tax-saving advice.

Speedy ITR Filing in Mahisagar - Completed in One Day

Get in Touch with Our Tax Expert in Mahisagar. Share Your Documents for ITR Filing in Mahisagar.

Our Mahisagar Team will Prepare Income Tax Returns, Compute Income, and Taxes Using Your Information

Our Chartered Accountant based in Mahisagar will Review the Preliminary ITR and COI. Following their suggestion, we’ll furnish you with the final version.

After Completion, We’ll Submit the ITR for Mahisagar Client. Additionally, we’ll provide the CA Certified ITR and COI to your Mahisagar address.

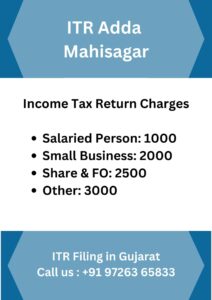

Cost of Income Tax Return Help in Mahisagar

Rates for ITR Filing Consultant in Mahisagar

Income from Employment (Salary): Rs. 1000

Income from Shares & Capital Gains: Rs. 2500

Small Business ITR: Rs. 2000

Partnership Firm / LLP: Rs. 3000

Company ITR: Rs. 3000

Trust ITR: Rs. 5000

CA – Tax Audit (if Required) for Clients in Mahisagar: Starting from Rs. 10,000/-

Required Documents for Income Tax Filing in Mahisagar

When Deciding to File Income Tax Returns in Mahisagar, You’ll Need:

For Employees: Form 16

For Small Businesses: Bank Statements

For Capital Gains: Bank Statements, Other Income Details, Property Sales Information

For Futures and Options Trading or Share Trading: Bank Statements, Futures and Options Profit/Loss Account, Capital Gains Tax Report

For Medium to Large Businesses: Accounting Records, GST Turnover Details, Sales and Purchase Records, etc.

Information on Deductions under Section 80C and Investment Details for Tax Purposes

Additionally, PAN, Aadhar Card, and Bank Details are Required for First-time Filers.

For a Full List of Documents Needed for Income Tax Filing, Click Here

Varieties of ITR for Filing Returns in Mahisagar for Individuals, Firms, and Companies

Let’s Explore ITR Forms for Residents, Companies, and Firms Registered in Mahisagar.

ITR-1: For Salary and Interest Income (Up to 50 lakhs).

ITR-2: For Income from Capital Gains/Losses, Investments, Agriculture Income, etc., excluding Business and Professional Income.

ITR-3: Suitable for Business and Professional Income.

ITR-4: For Businesses in Mahisagar Opting for Presumptive Taxation.

ITR-5: Applicable for Partnership Firms and LLPs.

ITR-6: Applicable for Companies (Private Ltd., Limited, Section 8, etc.)

In Need of Assistance with Salary Income Tax Returns in Mahisagar

Looking for help with filing your income tax returns? At ITR Adda, we provide budget-friendly packages starting from Rs. 500 for residents of Mahisagar. Our advisors can also assist you in claiming TDS refunds from the Mahisagar Income Tax Department.

When completing your tax returns, it’s important to choose between the Old Income Tax Regime and the New Tax Regime, which is the default option. We’ll analyze both regimes based on your personal details to help you make an informed decision.

Contact our Chartered Accountant for support with ITR filing in Mahisagar. Simply share your salary information or Form 16 for this financial year, and we’ll ensure your ITR is filed promptly.

Perks of Submitting Income Tax Returns in Mahisagar

In Mahisagar, submitting Income Tax Returns on time brings numerous benefits. Firstly, it ensures adherence to regulations, helping individuals and businesses avoid fines and interest charges. This promotes financial discipline and highlights accountability in tax matters. In Mahisagar’s flourishing economic landscape, filed ITRs play a crucial role in expediting loan approval processes for various types of loans. Additionally, they improve the likelihood of visa approvals, as foreign embassies often review tax compliance. Filing ITRs also unlocks opportunities for potential tax refunds, contributing to overall financial stability. Furthermore, in Mahisagar, where government assistance programs are income-based, filed ITRs serve as essential documentation for accessing benefits under various schemes. Get in touch with an ITR Filing Consultant in Mahisagar today for expert assistance with Income Tax Returns.

Income Tax Notice Support in Mahisagar

If you’ve got an Income Tax Notice in Mahisagar, no need to fret! Our Income Tax Notice Support Service is here to assist you. We have a team of specialists well-versed in tax regulations, and they’ll take care of the notice for you. They’ll collect the required information and ensure everything is resolved accurately. So, you can sit back and relax knowing that the tax notice is in good hands!

Income Tax Audit Support in Mahisagar

Explore our Income Tax Audit Assistance in Mahisagar, where our team, led by seasoned Chartered Accountants, simplifies the complexities of income tax compliance. Dealing with an audit? Our specialists ensure a seamless process, carefully reviewing your financial records and addressing any potential issues. With our thorough service, backed by the expertise of Chartered Accountants, we provide peace of mind, allowing you to focus on your main tasks while we handle your tax affairs meticulously. Count on us to navigate you through the audit process efficiently and smoothly.

CA Tax Audit is Required if the Business:

Has a Turnover of over One Crore //OR// Records a Profit of less than 6 Percent or 8 Percent

For Professionals, Tax Audit is Required if:

Gross Receipts exceed 50 Lakhs or Profit is less than 50 Percent.

ITR Adda in Mahisagar and Nearby District Office

ITR Adda Office – Near Mahisagar Location (Soon)

B/H Bus Stand, Lunawada Dist: Mahisagar, 389230

Also We are Providing ITR Filing Service in District of Aravali, Dahod, Panchmahal, etc Consist City of Mahisagar,Lunawada, Balasinor, Khanpur, Santrampur, and Kadan, etc.