ITR Filing Consultant in Narmada

Looking for an Income Tax Filing Consultant in Narmada? We’re a group of Chartered Accountants (CAs) and tax advisors located in Narmada, providing seamless income tax return filing services. Get quick help with ITR filing with us. Our Narmada consultancy team will create a draft ITR and calculate your income (COI) based on your documents, AIS, TIS, and 26AS. Once you approve, we’ll submit the online income tax return for you. Additionally, our team will offer advice on tax-saving techniques.

Looking For ITR Filing Consultant/CA in Narmada?

Income Tax Filing Assistance in Narmada

Are you in need of expert help with Income Tax Return filing in Narmada? Similar to Narmada, this area experiences a steady increase in Income Tax Returns and taxpayers each year. With a thriving startup and business environment, there’s also a growing number of salaried individuals. Filing Income Tax Returns has become essential for individuals and businesses in Narmada, as well as neighboring areas like Bardoli, Navsari, Chikhli, and Vyara.

In Narmada, there are five primary types of taxpayers: salaried individuals, small businesses, large corporations, stock market participants, and F&O traders. Residents of Narmada also earn income from both government and private jobs. Recognizing this diversity, our team comprises professional Chartered Accountants (CAs) and Tax Lawyers with extensive experience in Income Tax Filing.

We provide a complete solution for Income Tax Services in Narmada, offering thorough ITR filing and tax planning tailored specifically for taxpayers in the region. With our expertise as ITR Filing Consultants in Narmada, we strive to streamline the Income Tax filing process, ensuring compliance and offering valuable tax-saving advice.

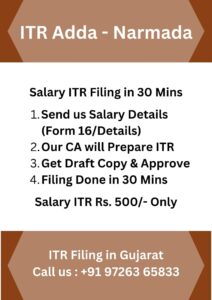

Income Tax Filing in Narmada - Done in One Day

Get in touch with our Tax Expert in Narmada. Share your documents for Income Tax Return Filing in Narmada.

Our team in Narmada will prepare a draft Income Tax Return, compute income, and tax based on the provided details.

Our Chartered Accountant designated for Narmada Income Tax Return (ITR) will examine the draft ITR and COI. Following their guidance, we will provide you with the final draft.

After completion, we’ll file the Income Tax Return (ITR) for our Narmada client. Additionally, we’ll deliver the CA certified ITR and COI directly to your doorstep in Narmada.

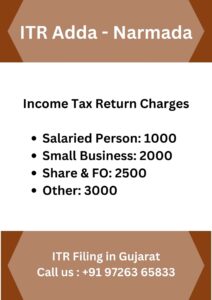

Charges for Income Tax Return Filing Consultancy in Narmada

Pricing for ITR Filing Assistance in Narmada

Salary Income Tax Return – Individual Employed in Narmada: Rs. 1000

Returns for Shares & Capital Gains: Rs. 2500

Small Business Tax Return in Narmada: Rs. 2000

Partnership Firm / LLP Tax Return for Narmada Location: Rs. 3000

Company Tax Return: Rs. 3000

Trust Tax Return: Rs. 5000

CA – Tax Audit Service for Clients in Narmada (if Required): Starting from Rs. 10,000/-

Which Papers Needed to File Taxes in Narmada

What Papers Do You Need to File Taxes in Narmada, Based on Your Job?

For Employees – Form 16 For Small Businesses – Bank Statements For Capital Gains – Bank Statements, Details of Other Income, and Property Sale Information For Futures & Options (F&O) Trading or Share Trading – Bank Statements, F&O Profit and Loss Account, Capital Gains Tax Report For Medium to Large Businesses – Financial Records, GST Turnover, Sales and Purchase Records, etc. For Deductions under Section 80C and Investment Information for Tax Purposes

In addition to these, you’ll also need your PAN card, Aadhar Card, and Bank Details if it’s your first time filing taxes.

For a complete list of documents needed for filing taxes, click here

Tax Forms for Narmada: Individuals, Firms, and Companies

Let’s See Which Tax Form to Use for Narmada Residents, Companies, and Firms Registered in Narmada.

Form ITR-1: For Salaries and Interest Earnings in Narmada (Up to 50 lakhs).

Form ITR-2: For Income from Buying/Selling Property in Narmada, Investments in Stocks, Mutual Funds, Agriculture Earnings, etc., for Individuals or HUFs. Individuals with Business and Professional Income Cannot Use Form ITR-2.

Form ITR-3: Suitable for Business and Professional Earnings of Narmada Business Owners.

Form ITR-4: For Narmada-Based Businesses Opting for Presumptive Taxation (Lumpsum).

Form ITR-5: Applicable for Partnership Firms and LLPs in Narmada.

Form ITR-6: Applicable for Companies in Narmada (Private Limited, Limited, Section 8, etc.)

Income Tax Filing Help for Salary Earners in Narmada

Seeking expert guidance on filing your Income Tax Return in Narmada? At ITR Hub, we provide consultancy services customized for Narmada residents. Our team specializes in Income Tax Return filing services in Narmada, ensuring precise and prompt assistance.

Reach out to our ITR Filing Consultants in Narmada for tailored advice. Whether you require assistance with tax regimes or filing support, we’re here to assist you. Get in touch today for expert Income Tax Return filing services in Narmada.

Perks of Filing Income Tax Returns in Narmada

When Filing Income Tax Returns in Narmada, Required Documents Vary Based on Occupation:

For Salaried Individuals: Form 16 For Small Businesses: Bank Statements For Capital Gains: Bank Statements, Details of Other Income, and Property Sale Information For Futures & Options (F&O) Trading or Share Trading: Bank Statements, F&O Profit and Loss Account, Capital Gains Tax Report For Medium to Large Businesses: Financial Records, GST Turnover, Sales and Purchase Records, etc. For Deductions under Section 80C and Investment Details: Relevant Documentation for Tax Purposes

Additionally, PAN, Aadhar Card, and Bank Details are Required for First-Time Filers.

For a Full List of Documents Needed for ITR Filing, Click Here

Income Tax Notice Assistance in Narmada

If you’ve got an Income Tax Notice in Narmada, don’t worry! Our Income Tax Notice Response Service is here to help. We have a team of experts who know tax rules inside out. They’ll manage the notice for you, review the details, collect necessary information, and ensure everything is resolved accurately. With us handling the tax notice, you can relax and avoid unnecessary stress.

Income Tax Review Service in Narmada

Explore our Income Tax Assessment Service in Narmada, where our team, led by experienced Chartered Accountants, simplifies the complexities of income tax compliance. Facing an assessment? Our experts ensure a smooth process, meticulously reviewing your financial records and addressing any potential issues. With our comprehensive service, including the expertise of Chartered Accountants, we provide peace of mind, allowing you to focus on your core activities while we handle your tax matters with precision. Trust us to navigate the assessment process efficiently and effectively.

Chartered Accountant Tax Assessment Required if Business has:

- Turnover exceeding One Crore

- Profit less than 6% or 8%

For Professionals, Tax Assessment Required if Gross Receipts exceed 50 Lakhs or Profit is less than 50%.

Rely on our ITR Filing Consultant in Narmada and take advantage of our Income Tax Return Filing Assistance in Narmada.

Narmada & Nearby District Office - ITR Hub

ITR Adda Office – Coming Soon Near Narmada Location

Rajpipla Road, Moskut, Tal. Dediapada, Dist. Narmada, Gujarat – 392 201

Also We are Providing ITR Filing Service in District of Narmada, Bharuch, Valsad, Dediyapada, Navsari, etc Consist City of Rajpipla, Sagbara, Garudeshwar, Kevadia, Tilakwada, Nandod, and Dabhoi, etc.