ITR Filing Consultant in Patan

Need help filing your taxes in Navsari? We’re a group of Chartered Accountants and tax advisors located in Navsari, offering easy ITR filing services. Our Navsari team will prepare a rough draft of your tax return and calculate your income based on your documents and financial statements. After you give the green light, we’ll file your tax return online for you. We’ll also give you tips on how to save on taxes to help you keep more of your money.

Tax help in Patan? We've got you covered for ITR filing.

Income Tax Return Filing Assistance in Patan

Looking for expert help with filing your Income Tax Returns in Patan? As Patan sees a rise in Income Tax filings each year, especially with its growing startup and business scene, it’s becoming increasingly important for individuals and businesses alike to ensure their taxes are filed correctly.

Our team of experienced Chartered Accountants (CAs) and Tax Lawyers in Patan are well-versed in Income Tax Filing and cater to a diverse range of taxpayers, including salaried individuals, small businesses, large corporations, stock market investors, and F&O traders. Whether you earn income from government or private jobs, we’re here to assist you.

We offer comprehensive Income Tax Services tailored specifically for Patan residents, including assistance with ITR filing and tax planning. Our aim is to simplify the filing process, ensure compliance with tax regulations, and provide valuable advice on saving taxes. Connect with us today for expert assistance with filing your Income Tax Returns in Patan.

Quick ITR Filing in Patan - Completed in One Day

Get in touch with our dedicated tax specialist in Patan today. Just send us your documents for Income Tax Return filing in Patan, and we’ll take care of the rest.

Our team in Patan will create a preliminary Income Tax Return, calculate your income, and work out your taxes based on the information provided.

Our Chartered Accountant specializing in Patan ITR will review the initial ITR draft and income computation. After their input, we’ll send you the final version for your approval.

After finalizing, we’ll submit the ITR for our Patan clients. Additionally, we’ll deliver CA-certified ITR and income computation documents right to your doorstep in Patan.

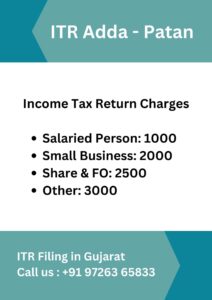

Pricing for Income Tax Filing Assistance in Patan

Documents Required for Income Tax Filing in Patan

For Income Tax Return Filing in Patan, you’ll need these documents based on your occupation:

- Salaried Person: Form 16

- Small Business: Bank Statement

- Capital Gain: Bank Statement, Other Income Details, Property Sale Details

- F&O Trading: Bank Statement, F&O Profit/Loss Account, Capital Gain Tax Report

- Medium to Large Business: Account Books, GST Turnover, Sales/Purchase Records

- Deduction 80C and Investment Details

Additionally, you’ll need PAN, Aadhar Card, and Bank Details if it’s your first time filing.

Varieties of ITR for Filing Returns in Patan: Individuals, Enterprises, and Corporations

Let’s Check Out ITR Forms for Residents, Companies, and Firms Registered in Patan.

ITR-1: For Patan Citizens with Salary and Interest Income (Up to 50 lakhs).

ITR-2: For Patan Residents with Income from Capital Gains/Loss on Property, Investments in Shares and Mutual Funds, Agriculture Income, etc. Business and Professional Income individuals cannot use ITR 2.

ITR-3: Suitable for Business and Professional Income of Entrepreneurs in Patan.

ITR-4: For Patan Businesses Choosing Presumptive Taxation (Lumpsum).

ITR-5: Applicable for Partnership Firms and LLPs in Patan.

ITR-6: Applicable for Companies in Patan (Pvt Ltd, Limited, Section 8, etc.).

Income Tax Help for Salaried Individuals in Patan

Planning to file your Income Tax Return (ITR) for your salary earnings? At ITR Solutions, we offer budget-friendly packages starting from Rs. 500/- for salaried individuals in Patan. Our knowledgeable advisor will aid you in obtaining TDS refunds from the Income Tax Department in Patan.

When filing your ITR as a salaried individual, it’s crucial to decide between the Old Income Tax Regime and the New Tax Regime. We’ll help you evaluate both options based on your personal financial situation.

Get in touch with our Chartered Accountant (CA) for ITR filing support in Patan. Just share your salary details or Form 16 for the current financial year, and we’ll ensure your ITR is filed promptly.

Benefits of Filing Income Tax Returns in Patan

In Patan, timely submission of your Income Tax Returns (ITR) offers numerous advantages. Firstly, it ensures adherence to tax laws, avoiding fines and interest fees, promoting financial responsibility.

In Patan’s thriving economy, filing your ITR plays a crucial role in simplifying loan applications, as lenders often require this documentation. Moreover, it can enhance your chances of securing a visa, as foreign embassies frequently review tax compliance records.

Submitting your ITR also opens avenues for potential tax refunds, improving your overall financial health. Additionally, in Patan, where many government schemes hinge on income levels, a filed ITR acts as valid proof, enabling access to various benefits under these programs. It serves as essential validation.

Contact our team of specialists at ITR Solutions in Patan for help with filing your Income Tax Returns and to capitalize on these advantages.

Income Tax Notice Help in Patan

If you’ve gotten an Income Tax Notice in Patan, don’t worry! Our team is here to help. We know tax laws and will manage the notice for you. We’ll collect the required details, deal with the specifics, and ensure everything is sorted out seamlessly. You can rely on us to handle the tax notice, giving you peace of mind knowing it’s being taken care of.

Income Tax Audit Support in Patan

Explore our Income Tax Audit Support in Patan, where our team, led by seasoned professionals, simplifies the complexities of income tax compliance. Facing an audit? Our experts ensure a seamless process, meticulously examining your financial records and addressing potential issues. With our all-inclusive service, we offer peace of mind, allowing you to concentrate on your core tasks while we efficiently handle your tax affairs. Count on us to lead you through the audit process effectively.

CA Tax Audit Needed for Businesses with:

- Turnover above One Crore //OR//

- Profit below 6% or 8%

For Professionals, Tax Audit Required if:

- Gross Receipts exceed 50 Lakhs //OR//

- Profit falls below 50%

Patan & Nearby District Office - ITR Corner

ITR Adda Office – Near Patan Location ( Soon)

Hingla Chachar, Station Road, Patan, 384265

Also We are Providing ITR Filing Service in District of Mehsana, Gandhinagar, Sabarkantha, Banaskantha, etc Consist City of Patan, Sidhpur, Chanasma, Harij, Sami, Radhanpur, Santalpur, Shankheshwar, Saraswati, Rani Ki Vav etc.