ITR Filing Consultant in Porbandar

Seeking help with filing your income tax returns in Porbandar? You’re in luck! Our team of Chartered Accountants and tax advisors, located right here in Porbandar, is here to assist you. We specialize in making the process of filing your income tax returns quick and easy. We’ll help you prepare your draft tax return and calculate your income based on the documents you provide. Once you’re satisfied with the draft, we’ll take care of filing your income tax return online. Additionally, we provide personalized advice on how you can save on taxes.

Looking for assistance with tax filing in Porbandar

Income Tax Filing Help in Porbandar

Need assistance with filing your income tax returns in Porbandar? As Porbandar’s business scene thrives, more and more people are filing taxes here each year. Whether you’re a salaried worker or a business owner, it’s crucial to stay on top of your tax obligations in this bustling city.

Porbandar’s taxpayers come from diverse backgrounds, including employees, small business owners, big corporations, investors, and traders. Our team of experienced Chartered Accountants (CAs) and Tax Advisors understands this diversity and specializes in income tax filing.

We provide a comprehensive range of income tax services in Porbandar, customized to suit the unique needs of local taxpayers. Our aim is to simplify the tax filing process and offer effective tax planning strategies to ensure compliance and maximize savings for individuals and businesses in Porbandar.

Income Tax Return Filing in Porbandar - Fast Service, Completed in Just One Day

Inquire and Connect with Our Tax Specialist in Porbandar. Submit Documents for Income Tax Return Filing in Porbandar.

Our Team in Porbandar will Create a Preliminary Income Tax Return, Calculate Your Income, and Determine Your Taxes Using the Information Provided.

Our Chartered Accountant, Assigned to Handle Porbandar Income Tax Returns, Will Review the Preliminary ITR and COI. Upon Their Recommendations, We’ll Provide You with the Final Draft.

After Finalizing, We’ll File the ITR for Our Porbandar Clients. Additionally, We’ll Deliver the CA Certified ITR and COI Right to Your Doorstep in Porbandar.

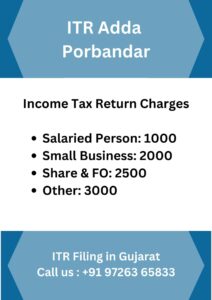

Cost for Tax Filing Help in Porbandar

Assistance Fees for Tax Returns in Porbandar:

- Salary Return – Individual with a Job in Porbandar: Rs. 1000

- Shares & Capital Gains Return: Rs. 2500

- Small Business Tax Return in Porbandar: Rs. 2000

- Partnership Firm / LLP Tax Return in Porbandar: Rs. 3000

- Company Tax Return: Rs. 3000

- Trust Tax Return: Rs. 5000

CA – Tax Audit for Clients in Porbandar (if Needed): Starting from Rs. 10,000.”

Documents Needed for Filing Income Tax in Porbandar

When completing your Income Tax Return in Porbandar, you’ll require specific documents based on your occupation:

- Salaried Worker: Salary Certificate (Form 16)

- Small Business Owner: Bank Statement showing business transactions

- Capital Gains: Bank Statement, Details of Additional Income, Property Sale Records

- Futures & Options Trading or Share Trading: Bank Statement, Profit and Loss Statement for Futures & Options, Capital Gains Report

- Medium to Large Business Owner: Financial Records such as Books of Accounts, GST Turnover, Sales and Purchase Records, etc.

Additionally, if you’re filing your taxes for the first time, you’ll need your PAN Card, Aadhar Card, and Bank Details.

For a comprehensive list of documents needed for ITR filing, click here.

ITR Types for Tax Filing for Individuals, Businesses, and Companies in Porbandar

Let’s Look at Different ITR Forms for Individuals, Companies, and Firms Registered in Porbandar.

ITR-1: For Income from Salary and Interest (Up to 50 lakhs).

ITR-2: Covers Income from Capital Gains, Property in Porbandar, Shares, Mutual Funds, Agriculture, but not Business or Professional Income.

ITR-3: Suitable for Business and Professional Income in Porbandar. ITR-4: Designed for Porbandar Businesses Choosing Presumptive Taxation.

ITR-5: Meant for Partnership Firms and LLPs in Porbandar.

ITR-6: Applicable to Companies, including Private Limited, Limited, and Section 8 Companies located in Porbandar.

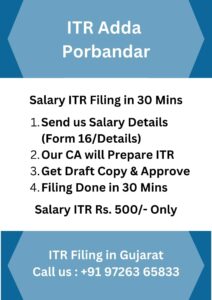

Income Tax Help for Porbandar Residents Who Earn a Salary

Do you need help with filing your salary income tax return? Here at ITR Help in Porbandar, we offer budget-friendly packages starting from just Rs. 500. Our skilled advisor will also guide you through claiming TDS refunds from the Income Tax Department.

When it comes to filing your salary income tax return, one crucial decision is choosing between the Old Income Tax Regime and the New Tax Regime. We’ll assess both options based on your individual circumstances.

Get in touch with our Chartered Accountant for assistance with ITR filing in Porbandar. Simply share your salary details or Form 16 for this financial year, and we’ll ensure your ITR is filed promptly.

Perks of Submitting Income Tax Returns in Porbandar

In Porbandar, submitting your Income Tax Return (ITR) on time brings many advantages. Firstly, it ensures compliance with tax rules, safeguarding individuals and businesses from penalties and fees. This fosters a sense of financial responsibility and control. Furthermore, a filed ITR facilitates smooth loan approvals and improves visa application success rates, as authorities often check tax compliance. It also creates opportunities for potential tax refunds, strengthening overall financial well-being. Additionally, in Porbandar, where government programs rely on income information, a filed ITR serves as valid evidence, enabling residents to access various scheme benefits. For expert help, contact our ITR Filing Consultant and Income Tax Return Filing Service in Porbandar.

Income Tax Notice Help Service in Porbandar

If you’ve received an Income Tax Notice in Porbandar, don’t worry! Our team is here to help with our Income Tax Notice Assistance Service. Our experts are familiar with tax laws and will manage the notice for you. They’ll review the details, gather necessary information, and ensure everything is resolved accurately. With us handling it, you can rest assured that your tax notice is being dealt with professionally. Also, if you require assistance with filing your Income Tax Return in Porbandar, our ITR Filing Consultants are available to help you with our Income Tax Return Filing Service.

Income Tax Audit Help in Porbandar

Explore our Income Tax Audit Support in Porbandar, where our team, led by skilled financial experts, simplifies the complexities of income tax compliance. Facing an audit? Our specialists ensure a smooth process, meticulously examining your financial records and addressing any potential issues. With our comprehensive service, bolstered by the expertise of financial professionals, we offer peace of mind, allowing you to focus on your core activities while we manage your tax matters with precision. Rely on us to guide you through the audit process efficiently and effectively.

For Businesses in Porbandar:

A Tax Audit is Necessary if the Turnover exceeds One Crore, OR if the Profit is below 6% or 8%.

For Professionals in Porbandar:

A Tax Audit is Mandatory if the Gross Receipts surpass 50 Lakhs, OR if the Profit falls below 50%.

Porbandar & Surrounding District Office - Tax Filing Hub

ITR Adda Office – Near Porbandar Location ( Soon)

Chhaya Road, Kamlbaug Porbandar, 360575

Also We are Providing ITR Filing Service in District of Dwarka, jamnagar, Janagadh, Rajkot, etc Consist City of Porbandar,Kasturba Road, Chhaya Chowk, Sardar Bag,Teen Batti, M.G. Road ,Chowpati, Dariyanagar, Nagardas Road etc.