ITR Filing Consultant in Surat

Are you looking for an ITR filing consultant in Surat? We are a Surat-based team of Chartered Accountants (CAs) and tax consultants providing income tax return filing services. Get hassle-free ITR filing service instantly. Our Surat consultancy team will prepare a draft ITR and computation of income (COI) based on your documents, AIS, TIS, and 26AS. After that, upon your approval, we will file the online income tax return for you. Additionally, our team will guide you with tax-saving suggestions.

Interested in ITR Filing Consultant/CA in Surat?

Income Tax Return Filing Service in Surat

Are you in search of expert assistance for Income Tax Return filing in Surat? As Surat witnesses a continual rise in Income Tax Returns and taxpayers each year, being the thriving hub of the Diamond City. The city experiences rapid growth in startups and businesses, resulting in an increasing number of salaried individuals. As this dynamic region continues to flourish, the meticulous process of Income Tax Return Filing becomes crucial for individuals and businesses in Surat, Bardoli, Navsari, Chikhli, Vyara, and other areas. Therefore, filing Income Tax Returns for salaried professionals, business firms, and companies has become a crucial task in Surat.

In Surat, there are five main types of taxpayers, including the salaried segment, small business units, large corporations, stock market participants, and F&O traders. Additionally, individuals working in Surat hold both government job income and private job income. Recognizing the diverse nature of taxpayers in Surat, our team comprises professional Chartered Accountants (CAs) and Tax Lawyers with extensive experience in Income Tax Filing.

We serve as a one-stop solution for Income Tax Services, offering comprehensive ITR filing and tax planning specifically tailored for Surat-based taxpayers. With our expertise, we aim to simplify the Income Tax filing process for individuals and entities in Surat, ensuring compliance and providing valuable tax-saving suggestions.

Quick ITR Filing in Surat

Ask questions and get in touch with our Surat tax expert. Send us your documents for ITR filing in Botad.

Our Surat team will create a draft Income Tax Return, compute your income, and calculate taxes based on your information.

Our dedicated Chartered Accountant for Surat ITR will review the draft ITR and COI. After their suggestions, we’ll share the final draft with you.

After finalizing, we’ll submit your ITR in Surat. Additionally, we’ll deliver the CA-certified ITR and COI to your doorstep in Surat.

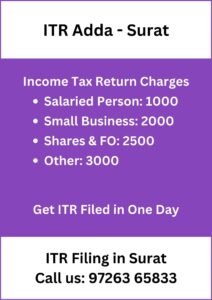

Charges for Income Tax Return Filing Consultancy in Surat

Charges for ITR Filing Consultant in Surat

- Salary Return – Individual Person Who is Having Job in Surat: Rs. 1000

- Shares & Capital Gain Return : Rs. 2500

- Surat Small Business ITR : Rs. 2000

- Partnership Firm / LLP of Surat Location ITR : Rs. 3000

- Company ITR : Rs. 3000

- Trust ITR : Rs. 5000

- CA – Tax Audit for Surat Client (if Required) : Starting Rs. 10,000/-

Documents Required for Filing Income Tax in Surat

While Opting for Income Tax Return Filing in Surat, Based on Occupation Documents required.

- Salaried Person – Form 16

- Small Business – Bank Statement

- Capital Gain – Bank Statement, Other Income Details, and Selling of Property Details

- F&O Turnover or Share Trading – Bank Statement, F&O Profit and Loss Account, Capital Gain Tax Report

- Medium to Large Business – Books of Account, GST Turnover, Sales and Purchase Records etc.

- Deduction 80C and Investment Details for Tax Purpose

Apart from above document we need PAN, Aadhar Card and Bank Details if Person is Filing ITR First Time.

Types ITR for Return Filing for Surat Based Individual, Firm and Company

Let’s Explore ITR Form for Surat Citizen, Company and Firms Registered at Surat Address.

- ITR-1: Salary and Interest Income in Surat (Upto 50 lakhs).

- ITR-2: Income from Capital Gain/Loss on Surat Property, Investment in Shares and Mutual Fund, Agriculture Income etc. of Individual or HUF. Business and Profession Income Person Cannot file ITR 2.

- ITR-3: Suitable for Business and Professional Income of Surat Businessmen.

- ITR-4: Surat Based Business Who is opting Presumptive Taxation (Lumpsum).

- ITR-5: Applicable for Partnership Firms and LLP.

- ITR-6: Applicable for Company (Surat Location Pvt Ltd, Limited, Section 8 etc)

Salary Income Tax Return Filing Advisor in Surat

Are you want to file ITR of your Salary Income? Here, at ITR Adda we provide cheapest package for Surat’s Salaried Person Income Tax Return Filing Starting from Rs. 500/- Only. Also, Our Advisor will help you in getting TDS Amount Refund from Income Tax Department of Surat.

Important Decision For Filing Salaried Person Income Tax Return is to Select Tax Regime as Government has two tax regime Called Old Income Tax Regime and New Tax regime (Default). We analyze both regime as per personalized data.

Connect with Our CA for ITR Filing Consultant in Surat. Send us Salary Details or Form 16 for this financial year and get your ITR Filed within hour.

Benefits of Income Tax Return Filing in Surat

In Surat City, timely Income Tax Return (ITR) filing holds several key advantages. Firstly, it ensures compliance, safeguarding individuals and businesses from penalties and interest. This not only fosters financial discipline but also reinforces responsibility in tax matters. In the thriving economic landscape of Surat, filed ITR plays a crucial role in facilitating smooth loan approval processes for various types of loans. Additionally, it enhances visa approval chances, as foreign embassies often scrutinize tax compliance. ITR filing also opens the door for potential tax refunds, contributing to overall financial well-being. Moreover, in a city where government schemes are income-based, filed ITR serves as valid proof, allowing residents to access benefits under various schemes, making it a key document for validation.

Income Tax Notice Response Service in Surat

If you’ve got an Income Tax Notice in Surat, don’t worry! Our Income Tax Notice Response Service is here to help you out. We have a team of experts who understand tax rules, and they’ll take care of responding to the notice for you. They’ll look into the details, gather the needed information, and make sure everything is sorted out properly. This way, you can relax and not stress about the tax notice – we’ve got it covered!

Income Tax Audit Service in Surat

Explore our Income Tax Audit Service in Surat, where our team, led by experienced Chartered Accountants, simplifies the complexities of income tax compliance. Facing an audit? Our experts ensure a smooth process, meticulously examining your financial records and addressing potential issues. With our comprehensive service, including the expertise of Chartered Accountants, we provide peace of mind, allowing you to focus on your core activities while we handle your tax matters with precision. Trust us to guide you through the audit process efficiently and effectively.

CA Tax Audit Required if Business having

- Turnover more than One Crore //OR//

- Profit is less than 6 Percent or 8 Percent

For Professionals Tax Audit Required if Gross Receipt is more than 50 Lakhs or Profit is less than 50 Percent.

Surat & Near District Office - ITR Adda

ITR Adda Office – Near Surat Location (Open)

Anand Mahal Road, Near Gail Tower, Adajan, Surat – 395009

Also We are Providing ITR Filing Service in District of Bharuch, Valsad, Surat, Navsari, etc Consist City of Surat, Choryasi, Olpad, Mangrol, Bardoli, Umarpada, and Kamrej, Bharuch, Ankleswar, Navsari, Vapi, Valsad, Dang, etc.