ITR Filing Consultant in Valsad

Are you seeking an ITR filing consultant in Valsad? We are a team of Chartered Accountants (CAs) and tax consultants based in Valsad, providing hassle-free income tax return filing services. Get your ITR filed instantly with us. Our Valsad consultancy team, including experienced CAs, will prepare a draft ITR and computation of income (COI) based on your documents, AIS, TIS, and 26AS. Once approved by you, we’ll file the online income tax return for you. Additionally, we’ll offer tax-saving suggestions to maximize your savings.

Tax filing help in Valsad? Need a consultant or CA?

Income Tax Filing Assistance Available in Valsad

Seeking professional assistance for your Income Tax Returns in Valsad? Much like Valsad, Vapi, Surat experiences a consistent rise in taxpayer numbers annually, owing to its position as a thriving hub in the vicinity. With an evolving landscape in startups and enterprises, coupled with a growing populace of salary earners, the meticulous filing of Income Tax Returns remains paramount for residents and businesses in Valsad and neighboring regions such as Bardoli, Navsari, Chikhli, and Vyara. Income Tax Filing Assistance is readily available in Valsad to address your needs.

In Valsad, taxpayers encompass a wide array of categories, ranging from salaried professionals and small-scale enterprises to large corporations, stock market investors, and futures and options (F&O) traders. Additionally, a considerable number of individuals in Valsad derive income from both government and private sector employment. Recognizing the diverse landscape of taxpayers, our team comprises seasoned Chartered Accountants (CAs) and Tax Lawyers well-versed in Income Tax Filing practices. With Income Tax Filing Assistance readily available in Valsad, we cater to the multifaceted needs of our clients.

We provide extensive Income Tax Services meticulously crafted for taxpayers based in Valsad, positioning ourselves as the premier ITR Filing Consultants in the region. Our objective is to streamline the Income Tax filing journey for both individuals and enterprises in Valsad, ensuring adherence to regulations while furnishing invaluable tax-saving insights.

Get Your ITR Filed in Valsad - Same Day Service

Initiate an inquiry and engage with our specialized tax expert in Valsad. Kindly forward your documents for Income Tax Return (ITR) filing in Valsad.

Our Valsad team will prepare your Income Tax Return, conducting thorough calculations of income and taxes in accordance with the information provided.

Our Chartered Accountant in charge of Valsad ITRs will review the draft ITR and COI. We’ll then share the final version based on their recommendations.

After finalizing, we’ll submit the ITR for Valsad clients and deliver the CA-certified ITR and COI to your doorstep.

Documents Needed for Income Tax Filing in Valsad

When filing your Income Tax Return in Valsad, you’ll need the following documents based on your occupation:

- Salaried Person: Form 16

- Small Business: Bank Statement

- Capital Gain: Bank Statement, Other Income Details, Selling of Property Details

- F&O Turnover or Share Trading: Bank Statement, F&O Profit and Loss Account, Capital Gain Tax Report

- Medium to Large Business: Books of Account, GST Turnover, Sales and Purchase Records, etc.

- Deduction 80C and Investment Details for Tax Purpose

Additionally, for first-time filers, PAN, Aadhar Card, and Bank Details are required.

For the complete list of documents needed for ITR filing, click here.

Income Tax Return (ITR) Types for Individuals, Firms, and Companies based in Valsad

Outlined below are the various ITR forms applicable for filing returns in Valsad:

- ITR-1: Designed for individuals with income sourced from salary, pension, one house property, and additional sources.

- ITR-2: Intended for individuals and Hindu Undivided Families (HUFs) without income from business or profession.

- ITR-3: Tailored for individuals and HUFs deriving income from proprietary business or profession.

- ITR-4: Applicable for individuals, HUFs, and firms (excluding Limited Liability Partnerships) with income from proprietary business or profession.

- ITR-5: Suited for firms, Limited Liability Partnerships (LLPs), Association of Persons (AOPs), Body of Individuals (BOIs), artificial juridical persons, and cooperative societies.

- ITR-6: Designed for companies other than those claiming exemption under section 11.

Income Tax Filing Assistance for Salary Earners in Valsad

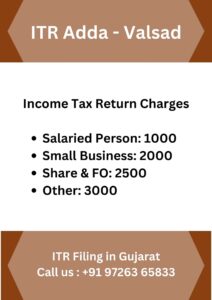

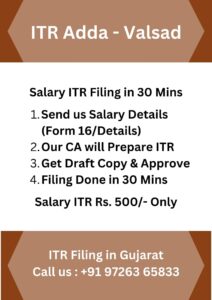

Need help filing your salary income tax return? At ITR Adda, we offer affordable packages for Valsad’s salaried individuals, starting from just Rs. 500/-! Our expert advisor will also assist you in claiming TDS refunds from the Income Tax Department of Valsad.

When filing your tax return as a salaried individual, it’s crucial to choose between the Old Income Tax Regime and the New Tax Regime. We’ll analyze both options based on your specific data.

Contact our CA for assistance with ITR filing in Valsad. Simply send us your salary details or Form 16 for this financial year, and we’ll ensure your ITR is filed promptly.

Perks of Completing Income Tax Returns in Valsad

In Valsad, filing your Income Tax Return (ITR) on time comes with several important benefits. Firstly, it ensures that you follow the rules, keeping you safe from fines and extra charges. This not only helps you manage your money better but also shows that you take your tax responsibilities seriously. In Valsad’s busy economy, submitting your ITR plays a big role in getting loans approved smoothly. It also increases your chances of getting a visa approved, as foreign embassies often check if you’ve paid your taxes properly. Filing your ITR can also lead to getting money back in taxes, which adds to your overall financial health. Moreover, in a city where government assistance depends on your income, having your ITR filed acts as proof, letting you access different benefits offered by government schemes. This makes it an important document for verifying your eligibility.

Income Tax Notice Assistance in Valsad

If you’ve received an Income Tax Notice in Valsad, no need to stress! Our team is here with our Income Tax Notice Response Service to assist you. We’ve got a group of specialists who know tax regulations well, and they’ll handle the response to the notice on your behalf. They’ll examine the details, collect necessary information, and ensure everything is handled correctly. So, you can sit back and relax knowing that we’ve got you covered with our ITR Filing Consultant and Income Tax Filing Support in Valsad!

Income Tax Audit Assistance in Valsad

Discover our Income Tax Audit Assistance in Valsad, where our team, led by experienced Chartered Accountants, simplifies the complexities of income tax compliance. Undergoing an audit? Our experts ensure a seamless process by carefully examining your financial records and addressing any potential issues. With our comprehensive service, backed by the expertise of Chartered Accountants, we provide peace of mind, allowing you to focus on your core activities while we handle your tax matters accurately. Count on us to efficiently guide you through the audit process.

CA Tax Audit Required if Business has:

- Turnover exceeding One Crore //OR//

- Profit less than 6 Percent or 8 Percent

For Professionals, Tax Audit Required if Gross Receipts exceed 50 Lakhs or Profit is less than 50 Percent.

Valsad & Nearby District Office - ITR Hub

ITR Adda Office – In Valsad Location ( Soon)

Mahalakshmi Tower Tital Road Valsad, 396001

Also We are Providing ITR Filing Service in District of Navsari, Dang, Daman, Tapi, etc Consist City of Valsad, Dharampur, UmbergaonPardi, Vapi, etc.