ITR Filing Consultant in Vijayapura

Are you in need of assistance with income tax return (ITR) filing in Vijayapura? Our firm comprises a dedicated team of Chartered Accountants (CAs) and tax consultants situated in Vijayapura, committed to providing seamless ITR filing services. Avail yourself of our prompt and dependable ITR filing service today. Our expert consultancy team in Vijayapura will meticulously prepare a draft ITR and calculate your income (COI) based on your documents, AIS, TIS, and 26AS. Following your approval, we will proceed to submit your online income tax return. Furthermore, we are equipped to offer valuable tax-saving recommendations to assist you in optimizing your returns.

Seeking Expertise in ITR Filing Consultant/CA Services in Vijayapura?

Income Tax Return Filing Expertise in Vijayapura

Are you in search of expert assistance for Income Tax Return filing in Vijayapura? With Vijayapura experiencing a consistent rise in taxpayers each year, efficient and accurate Income Tax Return Filing has become increasingly vital. This need extends beyond Vijayapura to neighboring areas such as Bardoli, Navsari, Chikhli, Vyara, and others, where startups and businesses are thriving. Rest assured, our team specializes in Income Tax Return Filing Expertise in Vijayapura, ensuring meticulous handling of your tax affairs.

In Vijayapura, the taxpayer demographic comprises five primary groups: employed individuals, proprietors of small businesses, executives of large corporations, participants in the stock market, and Futures and Options (F&O) traders. Similarly, individuals in Vijayapura often derive income from both governmental and private sector employment. Recognizing the diverse taxpayer landscape, our team is composed of seasoned Chartered Accountants (CAs) and Tax Lawyers well-versed in Income Tax Filing. Seeking Expertise in ITR Filing Consultant/CA Services in Vijayapura?

We provide comprehensive Income Tax Services customized for taxpayers based in Vijayapura. Our aim is to streamline the Income Tax filing procedure, ensuring adherence to regulations while delivering beneficial tax-saving guidance. Engage with our proficiency as your dependable ITR Filing Consultant in Vijayapura and depend on our prowess in Income Tax Return Filing Expertise in Vijayapura.

ITR Filing in Vijayapura - Expedited Process Available within One Day

Seek assistance and connect with our specialized tax expert in Vijayapura. Share your documents for ITR filing with us.

Our Vijayapura team will create a preliminary Income Tax Return, calculate your income, and assess taxes based on the provided information.

Our Chartered Accountant dedicated to Vijayapura’s ITR will review the draft ITR and COI. After considering their suggestions, we will share the final draft with you.

Once finalized, we will submit the ITR for our clients in Vijayapura. Additionally, we will provide CA-certified ITR and COI through doorstep delivery in Vijayapura.

Fee Structure for Income Tax Return Filing Consultation in Vijayapura

Fee Schedule for ITR Filing Consultant Services in Vijayapura

- Salary Return (Individual with job in Vijayapura): Rs. 1000

- Shares & Capital Gain Return: Rs. 2500

- Vijayapura Small Business ITR: Rs. 2000

- Partnership Firm / LLP in Vijayapura: Rs. 3000

- Company ITR: Rs. 3000

- Trust ITR: Rs. 5000

- Chartered Accountant (CA) Tax Audit for Vijayapura Client (if Required): Starting from Rs. 10,000/-

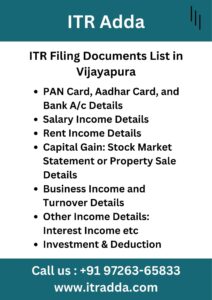

Documentation Necessary for Income Tax Filing in Vijayapura

When selecting Income Tax Return Filing services in Vijayapura, the requisite documentation varies based on your occupation:

- Employee with Salary Income: Form 16 Submission

- Entrepreneurs: Submission of Bank Statements

- Capital Gains: Bank Statements, Supplementary Income Documentation, and Property Transaction Records

- Stock Market Investors: Bank Statements, Financial Reports for Futures and Options (F&O), Capital Gains Tax Returns

- Established Enterprises: Accounting Books, GST Turnover Records, Comprehensive Sales and Purchase Documentation, etc.

- Tax Deduction 80C and Investment Particulars

Furthermore, alongside the aforementioned documents, it is imperative to furnish your PAN card, Aadhar Card, and Bank particulars, particularly if this marks your inaugural Income Tax Return (ITR) filing.

Types of ITR for Filing in Vijayapura: Individuals, Firms, and Companies

Exploring the ITR Forms for Residents, Companies, and Firms Registered in Vijayapura.

- ITR-1: Suitable for Individuals with Salary and Interest Income in Vijayapura (Up to 50 lakhs).

- ITR-2: Designed for Individuals or HUFs with Income from Capital Gain/Loss on Vijayapura Property, Investments in Shares and Mutual Funds, Agriculture Income, etc. Individuals with Business and Professional Income cannot use ITR 2.

- ITR-3: Appropriate for Vijayapura-based Businessmen with Business and Professional Income.

- ITR-4: Intended for Vijayapura-based Businesses opting for Presumptive Taxation (Lumpsum).

- ITR-5: Applicable for Partnership Firms and Limited Liability Partnerships (LLPs).

- ITR-6: Designed for Companies registered in Vijayapura (Private Limited, Limited, Section 8, etc.).

Income Tax Return Filing Consultancy for Salaried Individuals in Vijayapura

Seeking assistance with filing your salary income tax return? Look no further than ITR Adda. We provide budget-friendly packages tailored for salaried individuals in Vijayapura, starting from just Rs. 500/-. Our expert advisor will also guide you through the process of claiming TDS amount refunds from the Income Tax Department in Vijayapura.

When filing your income tax return as a salaried person, an important decision is to select between the Old Income Tax Regime and the New Tax Regime (which is the default). We analyze both regimes based on your personalized data.

When it comes to filing your income tax return as a salaried individual, a crucial decision lies in choosing between the Old Income Tax Regime and the New Tax Regime (which is the default option). At our firm, we carefully analyze both regimes based on your personalized data to determine the most advantageous approach for you.

Advantages of Filing Income Tax Returns in Vijayapura

In the city of Vijayapura, timely filing of Income Tax Returns (ITR) offers numerous significant benefits. Firstly, it ensures regulatory compliance, shielding individuals and enterprises from penalties and interest charges. This not only promotes financial prudence but also underscores accountability in tax affairs. In the vibrant economic milieu of Vijayapura, submitted ITR forms a pivotal component in expediting loan approval processes for diverse categories of loans. Additionally, it bolsters the likelihood of visa approval, given that foreign embassies frequently scrutinize tax adherence. ITR filing also paves the way for potential tax rebates, contributing to overall financial stability. Furthermore, in a city where government initiatives hinge on income criteria, filed ITR serves as substantive evidence, enabling residents to avail themselves of benefits under various schemes, thus rendering it a crucial document for authentication.

Income Tax Notice Handling Service in Vijayapura

Discover our Income Tax Audit Service in Vijayapura, where our team, led by seasoned Chartered Accountants, simplifies the intricacies of income tax compliance. Facing an audit? Our experts ensure a seamless process, meticulously scrutinizing your financial records and resolving potential issues. With our holistic service, incorporating the expertise of Chartered Accountants, we offer reassurance, enabling you to concentrate on your core endeavors while we manage your tax affairs with precision. Rely on us to navigate you through the audit process efficiently and effectively.

A Chartered Accountant (CA) Tax Audit is requisite if your business:

- Has a turnover exceeding One Crore //OR//

- Yields a profit less than 6 Percent or 8 Percent

For professionals, a Tax Audit is mandatory if gross receipts exceed 50 Lakhs or profits fall below 50 Percent.

Income Tax Audit Resolution Service in Vijayapura

Discover our Income Tax Audit Service in Vijayapura, where our team, led by experienced Chartered Accountants, simplifies the complexities of income tax compliance. Facing an audit? Our experts ensure a smooth process by meticulously examining your financial records and addressing potential issues. With our comprehensive service, including the expertise of Chartered Accountants, we provide peace of mind, allowing you to focus on your core activities while we handle your tax matters with precision. Trust us to guide you through the audit process efficiently and effectively.

CA Tax Audit is required for businesses in Vijayapura if:

- Turnover exceeds One Crore //OR//

- Profit is less than 6 Percent or 8 Percent

For professionals in Vijayapura, Tax Audit is required if:

- Gross Receipts exceed 50 Lakhs //OR//

- Profit is less than 50 Percent.

Rely on our ITR Filing Consultant in Vijayapura and our Income Tax Return Filing Expertise in Vijayapura to ensure seamless handling of your tax affairs.

Vijayapura & Near District Office - ITR Adda

ITR Adda Office – Adjacent to Vijayapura Location (Operational)

Devanahalli Taluk, Vijayapur Rural, 562135

Additionally, we extend our ITR Filing Services to districts including Kalaburagi, Raichur, Bagalkot, and others encompassing the city of Vijayapura, Bijapur, Muddebihal, Basavana Bagevadi, Sindgi, Talikoti, Indi, etc.