ITR Filing Consultant in Vijayawada

In need of an ITR filing consultant in Vijayawada? Look no further. Our experienced team of Chartered Accountants (CAs) and tax consultants in Vijayawada offers hassle-free services. We’ll prepare your draft ITR and COI based on your documents, AIS, TIS, and 26AS. Upon your approval, we’ll swiftly file your online income tax return and provide tax-saving suggestions. Simplify your tax filing process with us.

Looking for an ITR filing consultant or CA in Vijayawada?

Professional Tax Return Services in Vijayawada

Seeking ITR Filing Consultant in Vijayawada? With the city’s burgeoning status as the Diamond City, Vijayawada witnesses a consistent uptick in both Income Tax Returns and taxpayers annually. This trend is particularly evident due to the rapid proliferation of startups and businesses, contributing to a growing population of salaried individuals. As Vijayawada and its surrounding areas, including Bardoli, Navsari, Chikhli, and Vyara, thrive economically, the meticulous process of Income Tax Return Filing assumes paramount importance for individuals and businesses alike. Hence, the filing of Income Tax Returns for salaried professionals, business firms, and companies in Vijayawada emerges as a critical imperative.

In Vijayawada, a diverse array of taxpayer categories exists, encompassing the salaried sector, small-scale enterprises, large corporations, participants in the stock market, and F&O traders. Moreover, individuals in Vijayawada often derive income from both governmental and private sector employment. Acknowledging this varied landscape of taxpayers, our team is composed of seasoned Chartered Accountants (CAs) and Tax Lawyers possessing substantial expertise in Income Tax Filing.

We provide an all-encompassing suite of Income Tax Services, specializing in bespoke ITR filing and tax planning meticulously designed for taxpayers situated in Vijayawada. Leveraging our proficiency, our objective is to streamline the Income Tax filing procedures for both individuals and entities in Vijayawada, ensuring adherence to regulatory requirements while delivering insightful tax-saving recommendations.

Quick Turnaround for ITR Filing in Vijayawada

Connect with our specialized tax expert in Vijayawada and submit your documents for ITR filing today.

Our Vijayawada team will draft Income Tax Returns and compute taxes based on your details.

Our Vijayawada-based Chartered Accountant will review the draft ITR and COI before sharing the final draft with you based on their suggestions.

Upon finalization, we will promptly submit the ITR for our Vijayawada clients. Additionally, we offer doorstep delivery of CA certified ITR and COI documents in Vijayawada for your convenience.

Costs Associated with Income Tax Return Filing Consultation in Vijayawada

Vijayawada Employee Salary Return: Rs. 1000

- Capital Gains & Shares Return: Rs. 2500

- Shares & Capital Gain Return : Rs. 2500

- Income Tax Return Service for Small Enterprises in Vijayawada: Rs. 2000

- Vijayawada Partnership Firm / LLP Income Tax Filing: Rs. 3000

- Corporate Income Tax Filing: Rs. 3000

- Trust Income Tax Filing: Rs. 5000

- Tax Audit by CA for Clients in Vijayawada (if Needed): Commencing at Rs. 10,000/-

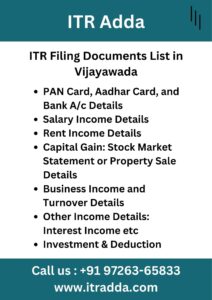

Documentation Required for Vijayawada Income Tax Filing

Income Tax Return Filing in Vijayawada: Occupation-Based Documentation Necessitated.

- Form 16 for Salaried Individuals

- Entrepreneurship – Financial Statements

- Gains on Investments – Bank Statements, Additional Income Particulars, and Property Sale Records

- Transactions in Futures & Options or Equity Trading – Bank Statements, Profit and Loss Account for Futures & Options, Tax Report on Capital Gains

- Business of Moderate to Substantial Size – Accounting Registers, GST Turnover Data, Sales and Procurement Documentation, and similar.

- Details of Section 80C Deductions and Investments for Tax Planning

In addition to the listed documents, PAN, Aadhar Card, and Banking Information are mandatory for individuals filing their Income Tax Returns for the first occasion

Get Access to the Complete Document Checklist for Income Tax Filing – Click Here

Various ITR Varieties for Vijayawada Residents, Enterprises, and Corporations Filing Their Returns

Let’s Explore ITR Form for Vijayawada Citizen, Company and Firms Registered at Vijayawada Address.

- Income Tax Return Form 1: Vijayawada Salary and Interest Revenue (Upto 50 lakhs).

- Income Tax Return Form 2: Capital Gains/Losses on Vijayawada Property, Shares, Mutual Funds, Agricultural Income, etc., for Individuals or HUFs. Individuals with Business or Professional Income are Not Eligible to File ITR 2.

- ITR-3 suits Vijayawada entrepreneurs who derive income from both their business endeavors and professional engagements

- ITR-4: Vijayawada Business Opting for Presumptive Taxation (Lump Sum) Method.

- ITR-5: Intended for Use by Partnership Entities and Limited Liability Partnerships (LLPs).

- ITR-6: Intended for Use by Companies (Private Limited, Limited, Section 8, etc.) Operating in Vijayawada

Looking for an advisor specialized in Salary Income Tax Return filing in Vijayawada?

Are you in need of professional tax return services in Vijayawada? At ITR Adda, we provide affordable packages for filing Income Tax Returns for Salaried Individuals, starting from just Rs. 500/-. Our expert advisors can also assist you in claiming refunds for TDS amounts from the Income Tax Department of Vijayawada.

When considering filing Income Tax Returns for salaried individuals in Vijayawada, a crucial decision revolves around selecting the tax regime. The government offers two options: the Old Income Tax Regime and the New Tax Regime (Default). At our professional tax return services in Vijayawada, we meticulously analyze both regimes based on personalized data to provide tailored guidance.

Seeking professional tax return services in Vijayawada? Connect with our CA for expert ITR filing consultancy. Simply send us your salary details or Form 16 for this financial year, and we’ll expedite the filing process, ensuring completion within an hour.

Benefits of Income Tax Filing Services in Vijayawada

In Vijayawada City, timely Income Tax Return (ITR) filing holds paramount importance, offering a myriad of advantages. It ensures compliance, shielding individuals and businesses from penalties and interest, thereby fostering financial discipline and reinforcing tax responsibility. In Vijayawada’s dynamic economic landscape, filed ITRs expedite loan approvals and increase visa approval chances, as foreign embassies scrutinize tax compliance records. Additionally, ITR filing opens avenues for potential tax refunds, enhancing overall financial well-being. Moreover, in a city where government schemes are income-based, filed ITRs serve as crucial validation documents, enabling residents to access benefits seamlessly. Seeking professional tax return services in Vijayawada ensures the efficient and compliant filing of ITRs, unlocking these benefits and opportunities.

Assistance for Income Tax Notice Responses in Vijayawada

For those facing an Income Tax Notice in Vijayawada, fret not! Our dedicated Income Tax Notice Response Service is your solution. With a team of seasoned experts well-versed in tax regulations, we manage the notice response process efficiently. From scrutinizing details to gathering requisite information, we ensure a thorough and precise resolution. Relax and let us handle the tax notice intricacies – your peace of mind is our priority!

For professional Income Tax Audit services in Vijayawada

Discover our professional Income Tax Audit Service in Vijayawada, where our team, led by seasoned Chartered Accountants, navigates the intricacies of income tax compliance seamlessly. Confronting an audit? Our experts streamline the process, meticulously analyzing your financial records and resolving potential issues. With our holistic approach, bolstered by Chartered Accountant expertise, we offer tranquility, enabling you to concentrate on core activities while we manage your tax affairs with precision. Count on us to shepherd you through the audit process proficiently and reliably.

In the event that a business possesses, a Tax Audit by a Chartered Accountant is necessary

- Business Turnover above One Crore //OR//

- Return is below 6 percent or 8 percent

Professionals are required to undergo a tax audit if their gross receipts surpass 50 Lakhs or if the profit falls below 50 percent.

ITR Station for Vijayawada and Vicinity Districts Office

ITR Adda Office – Near Vijayawada Location (Open Soon)

Benz Circle, M G Road, Vijayawada – 5200100

We offer our expert ITR Filing services in the district of Vijayawada, along with other areas such as Guntur, Krishna, West Godavari, and beyond. Our services cater to cities including Vijayawada, Tenali, Machilipatnam, Gudivada, Nuzvid, and more.