ITR Filing Service in Jhansi

Are you seeking an ITR filing consultant in Jhansi? We are a Jhansi-based team of Chartered Accountants (CAs) and tax consultants providing income tax return filing services. Get hassle-free ITR filing service instantly. Our Jhansi consultancy team will prepare a draft ITR and computation of income (COI) based on your documents, AIS, TIS, and 26AS. Upon your approval, we will file the online income tax return for you. Additionally, our team will provide guidance on tax-saving suggestions.

Additionally, we offer ITR Filing Service in Jhansi, providing tailored assistance to the local community.

Need help with filing taxes in Jhansi? Looking for a tax expert or accountant?

File Your income tax Return in Jhansi? Looking for an expert?

Need help with filing your taxes in Jhansi? With more and more people filing their taxes each year, especially with the growing number of businesses and startups in the Diamond City, it’s important to get expert assistance. Jhansi, Bardoli, Navsari, Chikhli, Vyara, and nearby areas are all seeing this rise in tax filings. Whether you’re a salaried individual or a business owner, filing your income taxes correctly is essential. That’s why having a reliable service for Income Tax Return filing in Jhansi is crucial.

In Jhansi, there are five main groups of people who pay taxes. These include people who earn salaries, small businesses, big companies, those who invest in the stock market, and those who trade in futures and options (F&O). Also, many people in Jhansi have jobs in both the government and private sectors. To help all these different kinds of taxpayers in Jhansi, our team has skilled Chartered Accountants (CAs) and Tax Lawyers who know a lot about filing income taxes.

We’re here to help with all your income tax needs in Jhansi. Our services include everything you need for filing your taxes and planning ahead. Our goal is to make the tax filing process easy for people and businesses in Jhansi, making sure everything is done correctly and offering ways to save on taxes.

File your income tax Return in Jhansi - Quick service, done in just one day!

Ask questions and talk to our tax expert in Jhansi. Send us your papers for filing taxes in Jhansi.

Our team will make a rough version of your tax return, figure out how much money you made, and calculate how much tax you owe based on the information you give us.

Our local accountant in Jhansi will look over the rough tax return and income details. After that, we’ll give you the final version based on their advice.

After we finish everything, we’ll send your tax return to the authorities in Jhansi. We’ll also give you certified documents, delivered right to your door in Jhansi.

Consultation Fees for Income Tax Filing Services in Jhansi

Fees for Income Tax Return Consultation in Jhansi

- Individual Salary Return (Employed in Jhansi): Rs. 1000

- Stock and Capital Gains Return: Rs. 2500

- Small Business Income Tax Return in Jhansi: Rs. 2000

- Partnership Firm / LLP Income Tax Return in Jhansi: Rs. 3000

- Company Income Tax Return in Jhansi: Rs. 3000

- Trust Income Tax Return in Jhansi: Rs. 5000

- Chartered Accountant Tax Audit for Jhansi Clients (if Necessary): Starting at Rs. 10,000/-

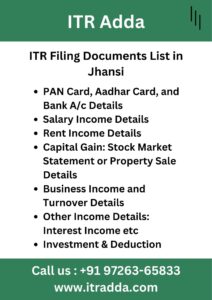

Documentation Needed for Income Tax Filing in Jhansi

When choosing to file Income Tax Returns in Jhansi, required documents vary based on occupation:

- Salaried Individuals: Form 16

- Small Business Owners: Bank Statements

- Capital Gains: Bank Statements, Additional Income Information, Property Sale Details

- Futures & Options (F&O) or Stock Trading: Bank Statements, F&O Profit/Loss Account, Capital Gains Tax Report

- Medium to Large Businesses: Accounting Records, GST Turnover, Sales and Purchase Documentation, etc.

- Details of Deductions under Section 80C and Investments for Tax Purposes

In addition to the above, individuals filing their Income Tax Returns for the first time will need PAN, Aadhar Card, and Bank Details.

For a comprehensive list of required documents for ITR filing, please refer to our provided link.

ITR Forms for Jhansi Individuals, Firms, and Companies

Let’s Explore the Suitable ITR Form for Individuals, Companies, and Firms Registered in Jhansi

- ITR-1: Designed for Individuals with Salary and Interest Income in Jhansi (Up to 50 lakhs).

- ITR-2: Suitable for Individuals or HUFs with Income from Capital Gains/Loss on Jhansi Property, Investments in Shares and Mutual Funds, Agriculture Income, etc. Business and Professional Income earners cannot use ITR 2.

- ITR-3: Appropriate for Business and Professional Income of Businesspersons in Jhansi.

- ITR-4: Intended for Jhansi-based Businesses opting for Presumptive Taxation (Lumpsum).

- ITR-5: Applicable for Partnership Firms and LLPs in Jhansi.

- ITR-6: Relevant for Companies (Private Limited, Limited, Section 8, etc.) with operations in Jhansi.

Income Tax Filing Guidance for Salaried Individuals in Jhansi

Are you seeking to file your Income Tax Return for your salary earnings? At ITR Adda, we offer affordable packages for Income Tax Return Filing specifically designed for salaried individuals in Jhansi, starting from Rs. 500 only. Additionally, our advisors are available to assist you in claiming TDS refunds from the Income Tax Department of Jhansi.

An important consideration in filing Income Tax Returns for salaried individuals is the selection of the tax regime. The government offers two tax regimes: the Old Income Tax Regime and the New Tax Regime (Default). We conduct a personalized analysis of both regimes based on your data to provide informed recommendations.

Reach out to our Chartered Accountant for expert assistance with Income Tax Return filing in Jhansi. Simply provide us with your salary details or Form 16 for the current financial year, and we’ll ensure your ITR is filed promptly within hours.

Advantages of Filing Income Tax Returns in Jhansi

In the city of Jhansi, timely submission of Income Tax Returns (ITR) offers numerous advantages. Firstly, it ensures adherence to tax regulations, shielding individuals and businesses from penalties and interest charges. This not only promotes financial discipline but also underscores accountability in tax affairs. In Jhansi’s vibrant economic environment, submitted ITR holds significant importance in expediting the approval process for diverse loan applications. Additionally, it heightens the likelihood of visa approval, as foreign diplomatic missions frequently scrutinize tax compliance records. ITR filing also presents opportunities for potential tax refunds, thereby bolstering overall financial stability. Furthermore, in a city where government initiatives are often contingent on income levels, filed ITR serves as credible documentation, enabling residents to avail themselves of benefits under various schemes, rendering it an essential validation document.

Income Tax Notice Resolution Service in Jhansi

If you’ve received an Income Tax Notice in Jhansi, rest assured. Our Income Tax Notice Response Service is at your disposal. Our team comprises seasoned experts well-versed in tax regulations, ensuring adept handling of notice responses on your behalf. We meticulously analyze the notice, gather requisite information, and address the matter diligently. With our expertise, you can alleviate concerns associated with the tax notice – your affairs are in capable hands.

Income Tax Audit Assistance in Jhansi

Discover our Income Tax Audit Service in Jhansi, where our team, led by seasoned Chartered Accountants, simplifies the complexities of income tax compliance. Are you facing an audit? Our experts ensure a seamless process by meticulously examining your financial records and addressing any potential issues. With our comprehensive service, bolstered by the expertise of Chartered Accountants, we offer peace of mind, enabling you to concentrate on your core activities while we handle your tax matters with precision. Rely on us to navigate you through the audit process efficiently and effectively.

Tax audits are mandatory for businesses meeting the following criteria:

- Turnover exceeding One Crore, or

- Profit less than 6% or 8%

For professionals, tax audits are necessary if gross receipts exceed 50 Lakhs or profit is less than 50 percent.

Jhansi & Near District Office - ITR Adda

Coming soon: ITR Adda Office – Close to Jhansi Location

Address: Shraddha Hills Colony, New Basti, Aantiya Talab, Main Road Jhansi – 284001

We also extend our ITR Filing Services to the Jhansi (city), Babina, Mauranipur, Moth, Chirgaon, Garautha, Erich, Parichha, Bangra, Baragaon, Manikpura, Panwari, Khailar, Mehrauni, Gursarai, Mau Ranipur, Samthar, and more.