ITR Filing Service in Mathura

Are you in search of an income tax return filing consultant in Mathura? We are a team of Chartered Accountants (CAs) and tax consultants based in Mathura, providing seamless services for filing income tax returns. Experience hassle-free ITR filing with us. Our Mathura consultancy team will create a preliminary ITR and compute your income based on the documents you provide, including AIS, TIS, and 26AS. Upon your approval, we will proceed to file your income tax return online. Furthermore, our team will offer guidance on tax-saving strategies tailored to your needs.

Interested in ITR Filing Consultant/CA in Mathura?

Income Tax Return Filing Expertise in Mathura

Are you seeking expert assistance for filing your Income Tax Returns in Mathura? Similar to Mathura, Mathura is experiencing a steady increase in the number of taxpayers each year, given its status as a bustling city. The growth of startups and businesses in Mathura has led to a rise in the number of salaried individuals as well. Consequently, the meticulous process of filing Income Tax Returns has become essential for residents and businesses in Mathura, as well as surrounding areas.

In Mathura, taxpayers belong to various categories, including salaried professionals, small business owners, large corporations, stock market participants, and traders. Additionally, individuals in Mathura may earn income from both government and private jobs. Acknowledging this diverse taxpayer landscape, our team in Mathura comprises seasoned Chartered Accountants (CAs) and Tax Lawyers proficient in Income Tax Filing.

We offer comprehensive Income Tax services tailored specifically for Mathura-based taxpayers, serving as a one-stop solution for all your needs. Our expertise extends to providing valuable tax-saving suggestions and assisting with tax planning. With our assistance, we aim to simplify the Income Tax filing process for individuals and entities in Mathura while ensuring compliance with regulations.

Get Your ITR Done Quickly in Mathura

Interested in learning more? Reach out to our specialized tax expert in Mathura. Simply send us your documents for Income Tax Return (ITR) filing.

Our team in Mathura will draft your Income Tax Return, compute your income, and calculate taxes based on the provided details.

Our dedicated Chartered Accountant in Mathura will review the draft Income Tax Return (ITR) and Computation of Income (COI). Once reviewed, we will share the final draft with you based on their suggestions.

After finalization, we will submit the Income Tax Return (ITR) for Mathura clients. Additionally, we will provide CA-certified ITR and COI through doorstep delivery in Mathura.

Charges for Income Tax Return Filing Consultancy in Mathura

Here are the charges for ITR filing services in Mathura:

- Salary Return (Individual with a job in Mathura): Rs. 1000

- Shares & Capital Gain Return: Rs. 2500

- Small Business ITR in Mathura: Rs. 2000

- Partnership Firm / LLP ITR in Mathura: Rs. 3000

- Company ITR in Mathura: Rs. 3000

- Trust ITR in Mathura: Rs. 5000

- CA Tax Audit (if required) for Mathura clients: Starting from Rs. 10,000/-

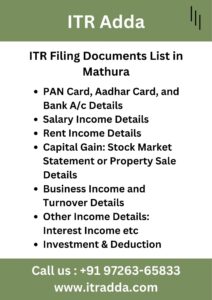

Documents Required for Filing Income Tax in Mathura

When filing Income Tax Returns in Mathura, here are the documents required based on occupation:

- Salaried Person: Form 16

- Small Business: Bank Statement

- Capital Gain: Bank Statement, Other Income Details, Selling of Property Details

- F&O Turnover or Share Trading: Bank Statement, F&O Profit and Loss Account, Capital Gain Tax Report

- Medium to Large Business: Books of Account, GST Turnover, Sales and Purchase Records, etc.

- Deduction 80C and Investment Details for Tax Purpose

Additionally, PAN, Aadhar Card, and Bank Details are required if filing ITR for the first time. For a complete list of documents for ITR filing, click here.

Assortment of ITRs for Tax Compliance in Mathura: Individuals, Businesses, Entities

Let’s Explore ITR Forms for Mathura Residents, Companies, and Firms Registered in Mathura.

ITR-1: For Salary and Interest Income in Mathura (Up to 50 lakhs).

ITR-2: For Income from Capital Gain/Loss on Mathura Property, Investment in Shares and Mutual Fund, Agriculture Income, etc. of Individual or HUF. Business and Profession Income Individuals Cannot File ITR 2.

ITR-3: Suitable for Business and Professional Income of Mathura Businessmen.

ITR-4: For Mathura-Based Businesses Opting for Presumptive Taxation (Lumpsum).

ITR-5: Applicable for Partnership Firms and LLPs in Mathura.

ITR-6: Applicable for Companies Registered in Mathura (Private Ltd, Limited, Section 8, etc).

Income Tax Filing Guidance for Salaried Individuals in Mathura

Looking to file your Salary Income Tax Return (ITR)? Here at ITR Adda, we offer the most affordable packages for Mathura’s Salaried Individuals, starting from just Rs. 500/-. Additionally, our advisors can assist you in obtaining refunds for Tax Deducted at Source (TDS) from the Income Tax Department.

When filing your Income Tax Return as a Salaried Person, choosing between the Old Income Tax Regime and the New Tax Regime (Default) is an important decision. Our team analyzes both regimes based on your personalized data to help you make an informed choice.

Connect with our Chartered Accountant (CA) for expert ITR filing consultation in Mathura. Simply provide us with your salary details or Form 16 for the current financial year, and we’ll ensure your ITR is filed promptly.

Benefits of Income Tax Filing in Mathura

In Mathura City, filing your Income Tax Return (ITR) on time brings several important benefits. Firstly, it ensures compliance, protecting individuals and businesses from penalties and interest charges. This practice not only promotes financial responsibility but also strengthens adherence to tax regulations. In Mathura’s bustling economic environment, a filed ITR significantly aids in smooth loan approval processes across various categories. Moreover, it improves visa approval prospects, given the scrutiny by foreign embassies on tax compliance. Additionally, filing ITR opens avenues for potential tax refunds, bolstering overall financial stability. Furthermore, in a city where government initiatives often hinge on income criteria, a filed ITR serves as crucial evidence, enabling residents to access benefits under diverse schemes. Thus, it stands as a vital document for validation in Mathura’s financial landscape.

Need assistance with Income Tax Notices in Mathura

If you’ve received an Income Tax Notice in Mathura, there’s no need to worry! Our Income Tax Notice Response Service is here to assist you. We have a team of experts well-versed in tax regulations, ready to handle the notice on your behalf. They’ll carefully examine the details, gather necessary information, and ensure everything is addressed correctly. With our service, you can rest assured that your tax notice will be taken care of efficiently, allowing you to relax without stress. We’ve got you covered!

Income Tax Audit Service in Mathura

Discover our Income Tax Audit Service in Mathura, where our team, led by experienced Chartered Accountants, simplifies the complexities of income tax compliance. Facing an audit? Our experts ensure a smooth process, carefully examining your financial records and addressing any potential issues. With our comprehensive service, which includes the expertise of Chartered Accountants, we provide peace of mind, allowing you to focus on your core activities while we handle your tax matters with precision. Trust us to guide you through the audit process efficiently and effectively.

CA Tax Audit Required if Business having

Turnover more than One Crore //OR// Profit is less than 6 Percent or 8 Percent

For Professionals, Tax Audit is Required if Gross Receipt is more than 50 Lakhs or Profit is less than 50 Percent.

Mathura & Adjacent Area Office - ITR Plaza

ITR Adda Office – Near Mathura Location (Open)

Kotwali Rd, Dt – Mathura(Uttar Pradesh)Mathura, 281001

Also We are Providing ITR Filing Service in District of Agara, Aligarh, Mahamayanagar, etc Consist City of Mathura, Vrindavan, Govardhan, Barsana , Gokul, Radha Kund etc.