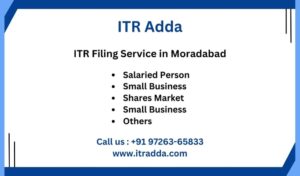

ITR Filing Service in Moradabad

Are you in need of assistance with filing your Income Tax Returns in Moradabad? We are a team of Chartered Accountants (CAs) and tax consultants based in Moradabad, offering hassle-free ITR filing services. With our prompt service, we’ll prepare a draft of your ITR and computation of income (COI) using your documents, AIS, TIS, and 26AS. Once approved by you, we’ll proceed to file your online income tax return. Our team will also provide guidance on tax-saving strategies to help you maximize your benefits.

Interested in ITR Filing Consultant/CA in Moradabad?

Income Tax Return Filing Service in Moradabad

Are you seeking expert help with Income Tax Return filing in Moradabad? As Moradabad witnesses a steady increase in Income Tax Returns and taxpayers annually, it has become a thriving center. The city experiences significant growth in startups and businesses, leading to a rise in salaried individuals. Given this dynamic environment, the meticulous process of Income Tax Return Filing becomes essential for individuals and businesses in Moradabad, as well as nearby areas like Bardoli, Navsari, Chikhli, and Vyara.

In Moradabad, taxpayers encompass various segments, including salaried individuals, small businesses, large corporations, stock market participants, and F&O traders. Additionally, individuals in Moradabad earn income from both government and private jobs. Acknowledging the diverse taxpayer landscape in Moradabad, our team consists of skilled Chartered Accountants (CAs) and Tax Lawyers with extensive experience in Income Tax Filing.

We offer a comprehensive solution for Income Tax Services, providing tailored ITR filing and tax planning services specifically designed for Moradabad-based taxpayers. With our expertise, we aim to simplify the Income Tax filing process for individuals and entities in Moradabad, ensuring compliance and offering valuable tax-saving advice.

ITR Filing in Moradabad- One Day Process

Please inquire and connect with our tax expert specializing in Moradabad. Kindly send us the necessary documents for filing your income tax return in Moradabad.

Our Moradabad team will create a draft of your income tax return, compute your income, and calculate taxes based on the information provided.

Our dedicated Chartered Accountant handling Moradabad ITRs will review the draft income tax return and computation of income. Once they provide their suggestions, we will share the final draft with you.

After finalizing the documents, we will submit your ITR for Moradabad clients. Additionally, we will deliver the CA certified ITR and computation of income to your doorstep in Moradabad.

Fee for Income Tax Return Filing Advisory in Moradabad

Fee Structure for ITR Filing Services in Moradabad

- Salary Income Tax Return for individuals employed in Moradabad: Rs. 1000

- Income from Shares & Capital Gains: Rs. 2500

- ITR for small businesses in Moradabad: Rs. 2000

- Partnership Firm / LLP located in Moradabad: Rs. 3000

- Company Income Tax Return: Rs. 3000

- Trust Income Tax Return: Rs. 5000

- CA Tax Audit (if required) for Moradabad clients: Starting at Rs. 10,000/-

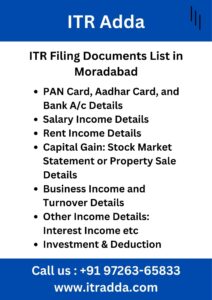

Necessary Documents for Income Tax Filing in Moradabad

When filing Income Tax Returns in Moradabad, the documents required vary based on occupation.

For Salaried Individuals: Form 16 For Small Business Owners: Bank Statements For Capital Gains: Bank Statements, Details of Other Income, and Property Sale Information For Futures and Options Trading or Share Trading: Bank Statements, Profit and Loss Account for F&O, Capital Gain Tax Report For Medium to Large Businesses: Books of Accounts, GST Turnover, Sales and Purchase Records, etc. Additionally, Deduction details under Section 80C and Investment Details for Tax Purposes are required.

In addition to the above, individuals filing ITR for the first time also need to provide PAN, Aadhar Card, and Bank Details.

For a comprehensive list of documents required for ITR filing, please click here.

Types ITR for Return Filing for Moradabad Based Individual, Firm and Company

Let’s explore the Income Tax Return (ITR) forms for residents, companies, and firms registered in Moradabad.

ITR-1: Suitable for individuals with salary and interest income in Moradabad (up to 50 lakhs).

ITR-2: Applicable for individuals or HUFs with income from capital gains/loss on Moradabad property, investments in shares and mutual funds, agriculture income, etc. Individuals with business and professional income cannot use ITR-2.

ITR-3: Designed for Moradabad businessmen with business and professional income.

ITR-4: Ideal for Moradabad-based businesses opting for presumptive taxation (lumpsum).

ITR-5: Suitable for partnership firms and LLPs in Moradabad.

ITR-6: Appropriate for companies registered in Moradabad (such as Pvt Ltd, Limited, Section 8, etc.).

Income Tax Recommendations for Salary Recipients in Moradabad

Are you considering filing your Income Tax Return (ITR) for your salary income? Here at ITR Adda, we offer the most affordable packages for Moradabad’s salaried individuals, starting from just Rs. 500/-. Additionally, our advisors can assist you in claiming TDS refunds from the Income Tax Department in Moradabad.

An important decision when filing your income tax return as a salaried individual is choosing the appropriate tax regime. The government offers two tax regimes: the Old Income Tax Regime and the New Tax Regime (Default). We provide personalized analysis for both regimes to help you make an informed decision.

Connect with our Chartered Accountant for ITR filing services in Moradabad. Simply send us your salary details or Form 16 for this financial year, and we’ll ensure your ITR is filed promptly within hours. Experience our dedicated Income Tax Return Filing Service in Moradabad today!

Benefits of Income Tax Filing in Moradabad

In Moradabad, timely filing of Income Tax Returns (ITRs) offers several notable advantages. Firstly, it ensures adherence to tax regulations, shielding individuals and businesses from fines and interest charges. This not only promotes financial discipline but also underscores accountability in tax affairs. In Moradabad’s vibrant economic environment, filed ITRs play a pivotal role in facilitating smooth loan approvals for various types of loans. Moreover, it improves the likelihood of visa approvals, as foreign embassies often scrutinize tax compliance records. ITR filing also presents opportunities for potential tax refunds, contributing to overall financial stability. Furthermore, in a city where government initiatives are often income-dependent, submitted ITRs act as valid evidence, enabling residents to access benefits under various schemes, thereby making it an essential document for verification. Experience our ITR Filing Service in Moradabad today and ensure your financial compliance.

Income Tax Notice Response Service in Moradabad

If you’ve received an Income Tax Notice in Moradabad, there’s no need to worry! Our Income Tax Notice Response Service is here to assist you. We have a team of experts well-versed in tax regulations, and they’ll handle the response to the notice on your behalf. They’ll thoroughly examine the details, gather necessary information, and ensure that everything is addressed properly. This allows you to relax and not stress about the tax notice – we’ll take care of it for you! Experience our ITR Filing Service in Moradabad and ensure smooth handling of your tax matters.

Income Tax Audit Assistance Service in Moradabad

Discover our Income Tax Audit Service in Moradabad, where our team, led by experienced Chartered Accountants, simplifies the complexities of income tax compliance. Facing an audit? Our experts ensure a smooth process, carefully examining your financial records and addressing potential issues. With our comprehensive service, including the expertise of Chartered Accountants, we provide peace of mind, allowing you to focus on your core activities while we handle your tax matters with precision. Trust us to guide you through the audit process efficiently and effectively.

CA Tax Audit is required for businesses in Moradabad if:

- Turnover exceeds One Crore //OR//

- Profit is less than 6% or 8%

For professionals in Moradabad, Tax Audit is required if:

- Gross Receipts exceed 50 Lakhs //OR//

- Profit is less than 50%.

Experience our ITR Filing Service in Moradabad and ensure smooth handling of your tax matters.

Moradabad & Near District Office - ITR Adda

ITR Adda Office – Near Moradabad Location (Open)

Brij Complex, Amroha Gate, Moradabad, 244001

Also We are Providing ITR Filing Service in District of Rampur, Bareilly, Budaun etc Consist City of Moradabad, Amroha, Joya, Thakurdwara, Kundarki, Chandausi etc.