ITR Filing Service in Solapur

Looking for assistance with filing your income tax returns in Solapur? Our team of Chartered Accountants (CAs) and tax consultants is here to help. We offer hassle-free ITR filing services tailored to your needs. Simply provide us with your documents, and our Solapur-based consultancy team will prepare a draft ITR and computation of income (COI). Once approved by you, we will handle the online filing of your income tax return. Plus, we’ll provide guidance on tax-saving strategies. Reach out to us today!

Looking For ITR Filing Consultant/CA in Solapur?

Reliable Income Tax Filing Services in Solapur

Are you seeking expert help with filing your Income Tax Returns in Solapur? Similar to Solapur, Solapur is witnessing a steady increase in taxpayers, owing to its status as a bustling commercial hub. With a growing number of startups and businesses in the region, as well as a rise in salaried individuals, the importance of meticulous Income Tax Return Filing cannot be overstated for residents and businesses in Solapur, including areas like Barshi, Akkalkot, Pandharpur, Sangola, and others.

In Solapur, there are five main categories of taxpayers, comprising salaried workers, small business owners, large corporations, stock market investors, and F&O traders. Additionally, individuals in Solapur often earn income from both government and private sector employment. Recognizing this diverse taxpayer landscape, our team comprises skilled Chartered Accountants (CAs) and Tax Lawyers with extensive experience in Income Tax Filing.

We offer a comprehensive range of Income Tax Services in Solapur, providing reliable ITR filing assistance and tailored tax planning solutions for individuals and businesses. Our goal is to simplify the Income Tax filing process for Solapur residents and entities, ensuring compliance while offering valuable tax-saving advice. Trust us for hassle-free and dependable Income Tax Filing Services in Solapur.

Quick Turnaround for ITR Filing in Solapur

Get in touch with our specialized tax expert in Solapur for inquiries and assistance. Send us your documents for Income Tax Return (ITR) filing in Solapur.

Our Solapur team will create a draft of your Income Tax Return, compute your income, and calculate your taxes based on the information provided.

Our Chartered Accountant Dedicated for Solapur ITR will Check the Draft ITR and COI. Based on their Suggestion we will share final draft to you.

Once Finalization, We will Submit ITR for Solapur Client. Also We will provide CA Certified ITR and COI at your Solapur Doorstep Delivery.

Consultation Charges for Income Tax Return Filing Services in Solapur

ITR Filing Consultant Charges in Solapur

- Salary Return for individuals employed in Solapur: Rs. 1000

- Shares & Capital Gain Return: Rs. 2500

- ITR for Small Businesses in Solapur: Rs. 2000

- Partnership Firm / LLP based in Solapur: Rs. 3000

- Company ITR in Solapur: Rs. 3000

- Trust ITR in Solapur: Rs. 5000

- Chartered Accountant (CA) Tax Audit for Solapur clients (if required): Starting from Rs. 10,000

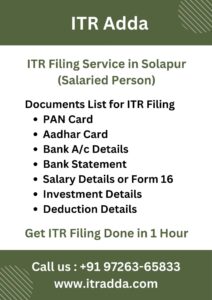

Documentation Required for Solapur Income Tax Filing

When filing Income Tax Returns in Solapur, required documents vary based on occupation:

- Salaried individuals: Form 16

- Small business owners: Bank statements

- Capital gains: Bank statements, details of other income, and property sale information

- Futures & Options (F&O) traders or share traders: Bank statements, F&O profit and loss account, capital gain tax report

- Medium to large businesses: Account books, GST turnover records, sales and purchase documents, etc.

- Details of deductions under Section 80C and investment information for tax purposes

Additionally, PAN card, Aadhar card, and bank details are needed for first-time filers.

For a comprehensive list of documents required for ITR filing, please click here.

Range of ITRs for Tax Record keeping in Solapur : Individuals, Enterprises, Corporations

Let’s explore the ITR forms for citizens, companies, and firms registered in Solapur:

ITR-1: Suitable for individuals with salary and interest income in Solapur (up to 50 lakhs). ITR-2: For individuals or HUFs with income from capital gains or losses on property in Solapur, investments in shares and mutual funds, agriculture income, etc. Individuals with business or professional income cannot use ITR-2. ITR-3: Ideal for Solapur-based businessmen with business and professional income. ITR-4: For Solapur-based businesses opting for presumptive taxation (lump sum). ITR-5: Applicable for partnership firms and LLPs in Solapur. ITR-6: Designed for companies located in Solapur, including Pvt Ltd, Limited, Section 8, etc.

Income Tax Consultation for Salaried Individuals in Solapur

If you’re looking to file your Income Tax Return (ITR) for your salary income, look no further! At ITR Adda, we offer the most affordable packages for Solapur’s salaried individuals, starting from just Rs. 500. Our advisors are also here to assist you in claiming refunds for TDS amounts from the Income Tax Department of Solapur.

Choosing the right tax regime is crucial when filing your Income Tax Return as the government offers two options: the Old Income Tax Regime and the New Tax Regime (Default). We’ll analyze both regimes based on your personalized data to help you make an informed decision.

Connect with our Chartered Accountant (CA) for ITR filing services in Solapur today. Simply send us your salary details or Form 16 for this financial year, and we’ll ensure your ITR is filed promptly, typically within an hour. Trust us for reliable Income Tax Filing Services in Solapur!

Benefits of Income Tax Filing in Solapur

In Solapur City, timely filing of Income Tax Returns (ITR) offers numerous benefits. Firstly, it ensures adherence to tax regulations, shielding individuals and businesses from fines and interest charges. This not only promotes financial responsibility but also underscores accountability in tax affairs. In Solapur’s vibrant economic environment, submitted ITRs play a vital role in expediting loan approval processes for different types of loans. Additionally, it improves the likelihood of visa approvals, as foreign embassies frequently scrutinize tax compliance records. ITR filing also paves the way for potential tax refunds, bolstering overall financial health. Furthermore, in a city where government initiatives are often income-based, submitted ITRs serve as essential documentation, enabling residents to access benefits under various schemes, making it a crucial validation document.”

Trust us for ITR Filing Services in Solapur and rely on our expertise for a smooth Income Tax Filing experience in Solapur

Handling Income Tax Notices in Solapur

If you’ve received an Income Tax Notice in Solapur, no need to panic! Our Income Tax Notice Response Service is at your disposal. We have a team of experts well-versed in tax regulations, ready to handle the notice on your behalf. They’ll review the details, collect necessary information, and ensure everything is addressed correctly. With us taking care of the notice, you can rest easy and alleviate any stress – we’re here to handle it for you!”

Count on our expertise for ITR Filing Services in Solapur and trust us for reliable Income Tax Filing Services in Solapur

Ease Your Tax Filing Process in Solapur

Discover our Income Tax Audit Service in Solapur, where our team, led by seasoned Chartered Accountants, simplifies the intricacies of income tax compliance. Facing an audit? Our experts ensure a seamless process, meticulously reviewing your financial records and addressing any potential issues. With our comprehensive service, bolstered by the expertise of Chartered Accountants, we offer peace of mind, allowing you to concentrate on your core activities while we handle your tax matters with precision. Trust us to navigate you through the audit process efficiently and effectively.

CA Tax Audit is necessary for businesses if:

- Turnover exceeds One Crore //OR//

- Profit is less than 6% or 8%

For Professionals, Tax Audit is required if:

- Gross Receipts exceed 50 Lakhs //OR//

- Profit is less than 50%

Count on us for ITR Filing Services in Solapur and rely on our expertise for dependable Income Tax Filing Services in Solapur!

Solapur & Near District Office - ITR Adda

ITR Adda Office – Near Solapur Location (Open)

Asara Soceity, Vip Road, Hotagi Road, Solapur, 416003

Also We are Providing ITR Filing Service in District of Beed, Pune, Sangli etc Consist City of Solapur, Akkalkot, Barshi, Pandharpur, Sangola, Mangalwedha, Kurduwadi etc.