What to Do If You Miss ITR Filing Deadline?

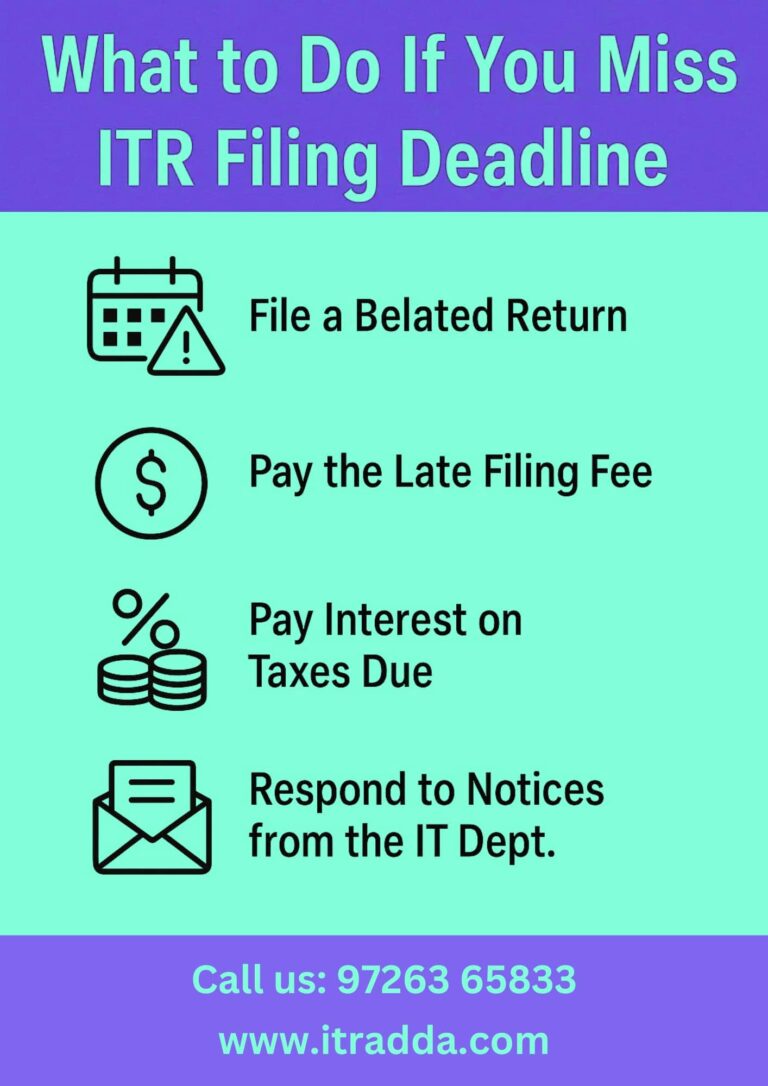

Welcome to our blog! Today, we will talk about what to do if you miss the ITR filing deadline. Missing your Income Tax Return (ITR) deadline is more common than you think, but don’t worry—there are ways to fix it. Even after the due date, you can still file your return by paying some penalties. In this article, we’ll guide you step by step on the consequences, penalties, and how to file a belated ITR easily to stay tax compliant. Filing on time is always better, but knowing the right steps after missing the deadline can save you from extra fines and legal hassles. So, let’s dive in and make the process simple for you.

Consequences of Missing the ITR Due Date

When you miss the ITR due date, the Income Tax Department can charge penalties and interest on your outstanding tax. The longer you delay, the higher the penalties can get. Even if you eventually file your return, you may have to pay extra fees for late submission. This can also include interest on any tax amount due, which keeps adding up until you file your ITR.

Apart from financial penalties, missing the deadline can affect your future tax benefits. For example, you may lose the ability to carry forward certain losses or claim deductions in upcoming years. It can also create problems when applying for loans, credit cards, or visas, as banks and authorities often check if your ITRs are filed on time. Filing a belated return as soon as possible helps reduce these issues and keeps your financial records clean. The good news is that even after missing the deadline, you still have options to get back on track without major complications.

Late Filing Fees Under Section 234F

If you miss the ITR filing deadline, you are required to pay a late filing fee under Section 234F. The fee depends on your total income. If your income is above ₹5 lakh, the late fee is ₹5,000, while for those earning below ₹5 lakh, the fee is ₹1,000. This fee applies regardless of whether you have tax payable or are getting a refund, so it’s important to be aware of it even if you have no outstanding tax.

This late fee is in addition to any interest on the tax you owe for the delayed period, which can keep adding up the longer you wait. Filing your ITR as soon as possible helps reduce these extra charges and avoids penalties for continuous delay. Staying aware of Section 234F ensures you remain compliant with tax regulations, prevents unnecessary financial stress, and keeps your tax records clean for future financial activities like applying for loans or visas. Remember, even after missing the deadline, paying the late fee and filing a belated return keeps you on the right side of the law.

Interest on Outstanding Tax (Sections 234A, 234B, 234C)

Section 234A: Charged if you file your ITR after the due date. The interest is calculated from the day after the due date until the date of filing.

Section 234B: Applies if you haven’t paid sufficient advance tax during the year. Interest is charged on the shortfall amount.

Section 234C: Levied when you defer or delay installment payments of advance tax. Each missed installment attracts additional interest.

Impact: These interest charges keep accumulating the longer you delay filing or paying taxes, increasing your overall tax burden significantly.

Additional Consequences: Delayed filing can also affect refunds, reduce financial benefits, and create complications for future compliance.

Solution: File your ITR and pay any outstanding taxes as soon as possible. Early action minimizes interest charges, late fees, and keeps your tax record clean.

Loss of Benefits Like Carry Forward of Losses

If you miss the ITR filing deadline, you may lose important tax benefits, such as the ability to carry forward certain losses. This includes business losses, capital losses, or losses from house property. Normally, carrying forward these losses helps you offset taxable income in future years, reducing your tax liability. But if you don’t file your return on time, these benefits are lost, which could result in higher taxes in the coming years. Filing a belated ITR as soon as possible ensures you safeguard these benefits and keep your tax planning on track.

How to File a Belated ITR Online?

We help you file your belated ITR easily through the Income Tax e-filing portal.

Our experts guide you to choose the correct ITR form and select “Belated Return.”

We assist in filling all income, deductions, and tax details accurately.

We calculate any late fees, penalties, or interest and help you pay them on time.

Our team ensures your ITR is submitted and verified properly.

We provide a downloadable acknowledgment for your records.

With our support, you can stay tax compliant without stress or mistakes.

Documents Needed for Belated ITR Filing

Before filing a belated ITR, it’s important to keep all necessary documents ready. Having them handy makes the process faster and reduces errors.

Documents Needed for Belated ITR Filing:

Form 16 / Salary Slips: To report your salary income and TDS details.

Form 26AS: Shows tax deducted and paid to the government.

Annual Information Statement (AIS) and Taxpayer Information Summary (TIS): Helps reconcile income and tax details.

Bank Statements: For interest income, deposits, or other transactions.

Investment Proofs: For claiming deductions under sections like 80C, 80D, etc.

Other Income Proofs: Rental income, capital gains, or any freelance/other income documents.

Can You File ITR After the Last Date?

Yes, you can still file your ITR after the original due date by submitting a belated return. Normally, the Income Tax Department allows belated filing up to 31st December of the assessment year, although this date can sometimes be extended by the CBDT. Filing after this extended period is generally not allowed, so it’s important to act quickly if you have missed the deadline. Submitting a belated return ensures you stay compliant, avoid unnecessary legal issues, and minimize penalties and interest charges.

Professional Help for Hassle-Free Belated ITR Filing

Filing a belated ITR can be tricky, especially with penalties, interest, and the risk of errors. Many taxpayers feel stressed trying to understand the rules and fill the forms correctly. With expert guidance, you can avoid mistakes, ensure all details are accurate, and calculate any late fees or interest properly. This makes the process smooth and stress-free.

At ITRAdda.com, our professionals assist you step by step—from gathering documents and calculating taxes to submitting and verifying your belated ITR. With our support, you can stay compliant with income tax laws without worrying about penalties or delays. Get help today and make your belated ITR filing quick, accurate, and hassle-free.

📞 Contact: +91 97263 65833

🌐 Website: itradda.com